5 Compelling Reasons to Be Long Gold

Aug. 20, 2024Gold tends to be a safe haven asset in times of economic uncertainty for its enduring value and lower correlation1 to traditional asset classes, offering a way to diversify portfolios. Amid ongoing geopolitical tensions, expected rate cuts, and market volatility, gold has been on a record run in 2024. Here are five reasons we believe it will continue to shine.

ETFs in Focus

Options Available on TMX – Montreal Exchange

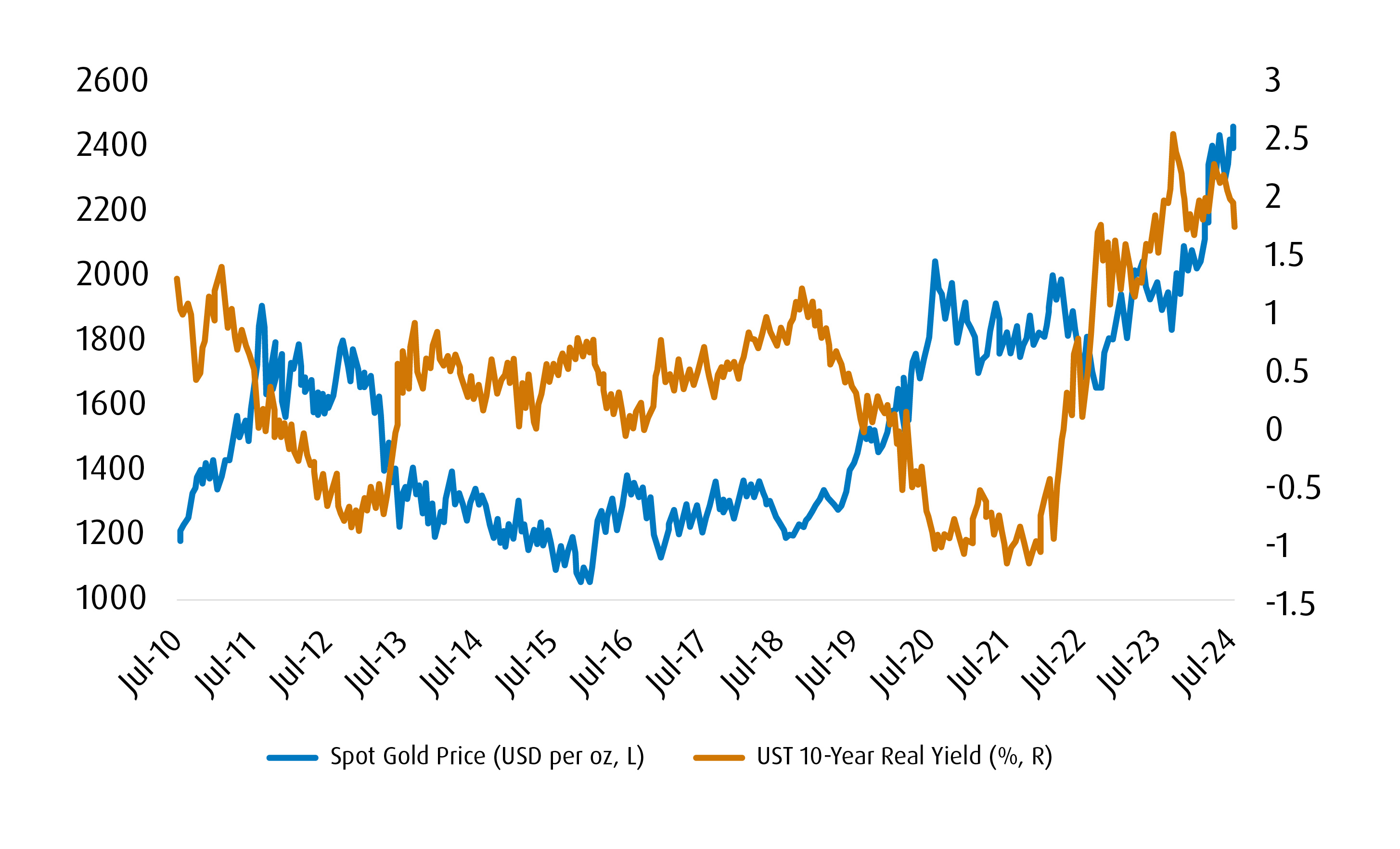

1. Gold’s Inverse Correlation with U.S. 10-Year Real Yields

For a long-time now, the price of gold has been inversely correlated U.S. 10-year real yields. What explains this relationship? Traditionally, the U.S. 10-year real yield has served as a proxy for what the market feels is the equilibrium level of growth in the United States. Currently, the market yield is around 1.8%,2 which is consistent with where most have trend growth penciled in. But when concerns with the trajectory of U.S. growth mount, investors will generally increase allocation to haven assets, like gold. Conversely, when sentiment on the U.S. economy is high (and expectations for long-term growth rate increase), investors will usually decrease weights for defensive assets like gold.

The Inverse Correlation Between Gold and U.S. 10-Year Real Yield

True, the strength of this relationship has ebbed a bit since the start of the rate hiking cycle in early 2022. Indeed, expectations for long-term growth in the U.S. have increased at the same time as gold prices have. However, we don’t believe that the nature of the relationship has changed structurally.

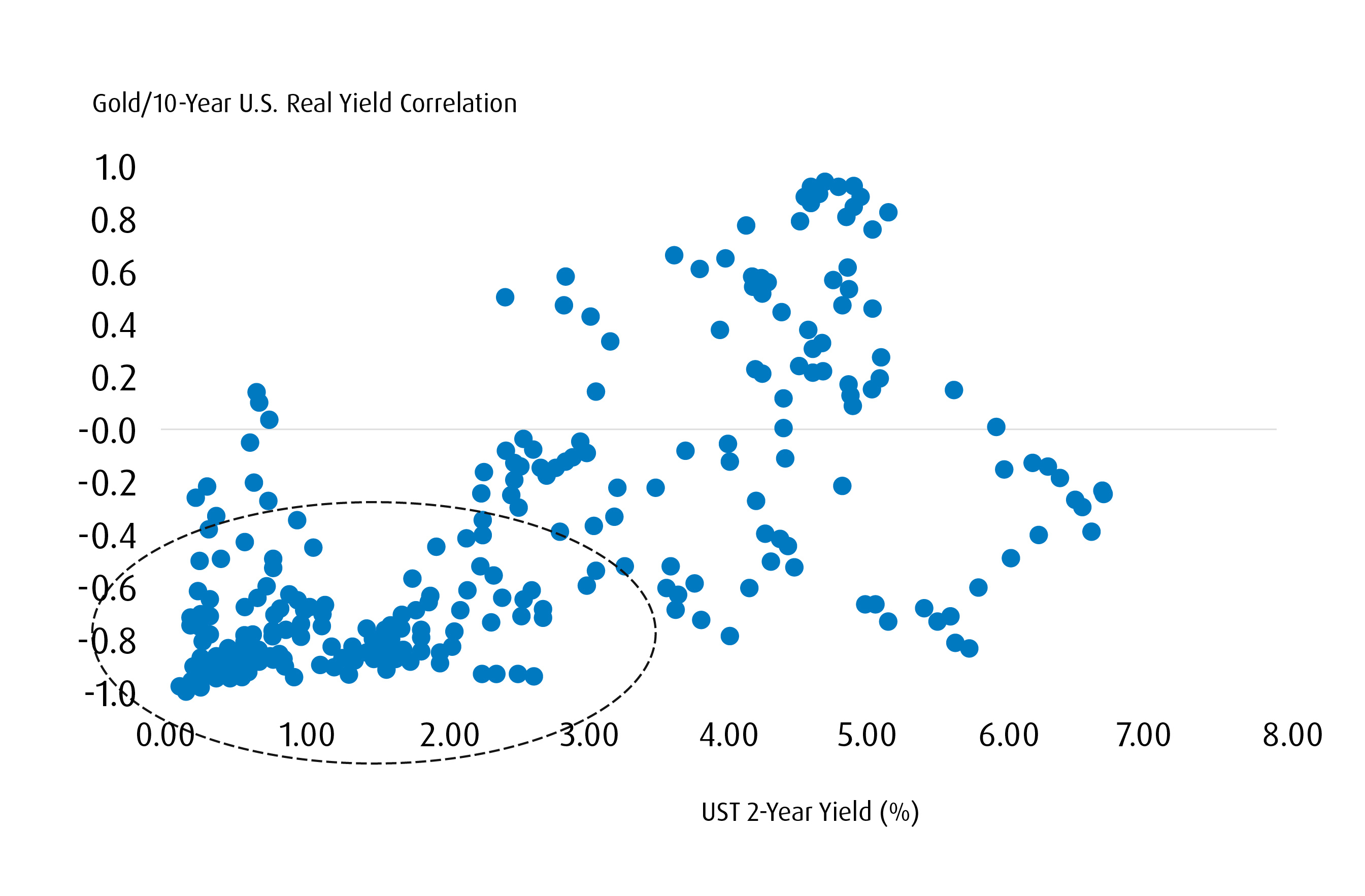

Instead, as interest rates head lower in the developed world, we expect the inverse correlation between the two series to reassert itself. That would be consistent with regimes that we’ve seen in the past — the strength of the correlation increases when interests are lower, as opposed to higher.

The Strength of the Correlation Increases When Interest Rates are Lower

Source: BMO GAM, as of August 15, 2024.

2. The Risks Are That the U.S. Economy Slows from Here

But for U.S. 10-year real yields to head lower, the market needs to reassess its long-term view of the U.S. economy.

Of late, it has been humming. However, there are signs that the labour market is struggling to absorb the large number of new entrants. That’s pushed the unemployment rate higher of late, and could portend to a softer consumption profile going forward. Additionally, business sentiment is expected to come under further strain the longer that financial conditions remain this tight. Commercial and industrial loans have slowed already, and negative growth there is usually consistent with a deeper slowdown in real activity.

As the U.S. Federal Reserve (Fed) begins its easing cycle, the market will be closely watching incoming data for any signs that the U.S. economy is slowing by more than expected. If so, there will be reassessments for long-term growth, which is generally constructive for gold prices.

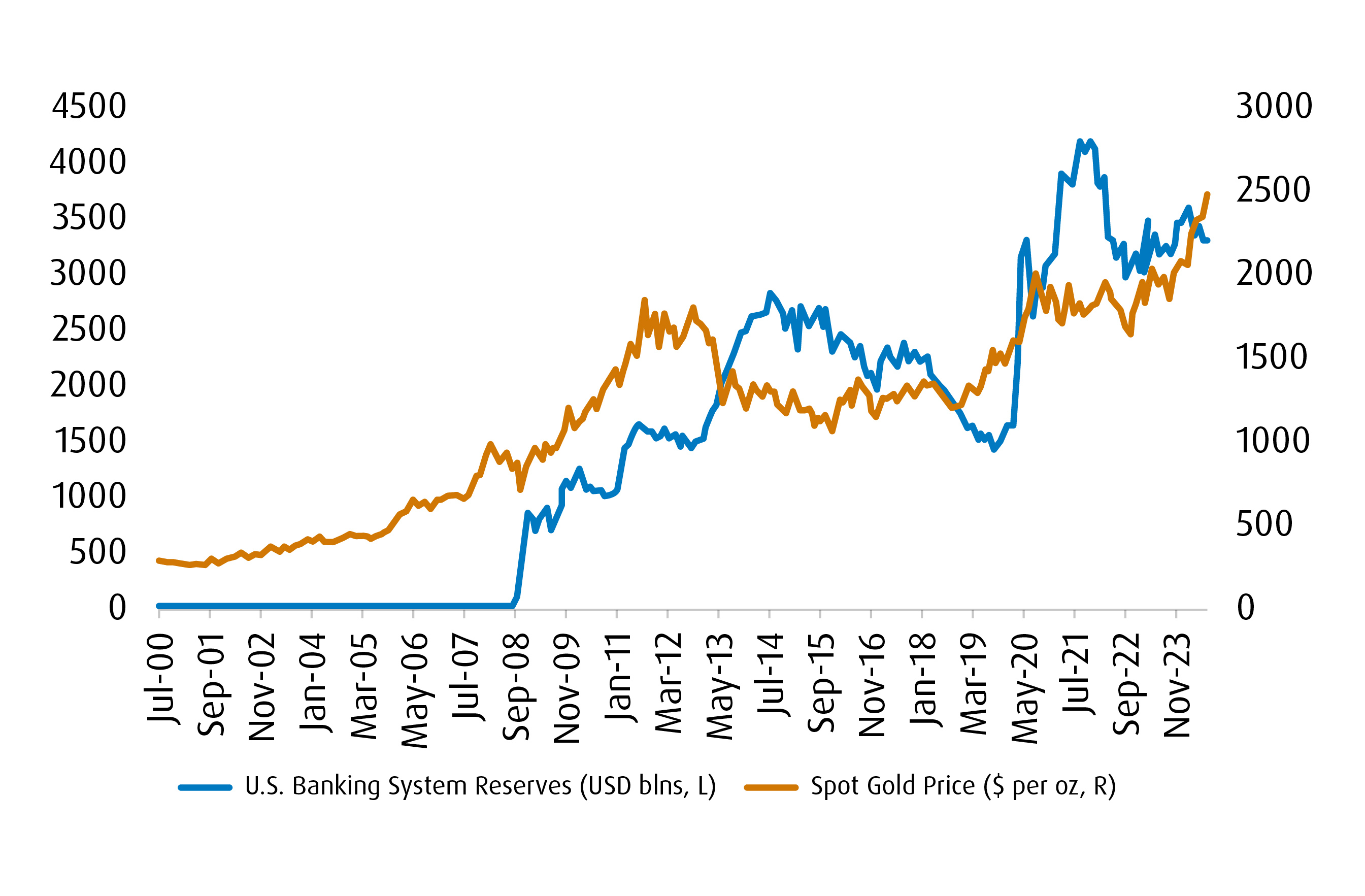

3. Fears of Monetary Debasement Are Still Alive

Over the past fifteen years, the Fed’s balance sheet has grown substantially. The primary reason for this is that the Fed has had to resort to unconventional policy (as quantitative easing, or QE) in order to stimulate activity whenever interest rates were at the zero lower bound. Put simply, the QE process means the Fed will expand its balance sheet through asset purchases, which also leads to a corresponding increase in the amount of reserves in the banking system (a liability for the Fed).

Remember, reserves in the banking system are a form of money. And an increase in the monetary base will usually flare up concerns of long-term U.S. dollar (USD) devaluation. The Fed’s balance sheet is now understood to be structurally larger because the quantitative tightening (QT) process, which is when the Fed allows its United States Treasury (UST) and mortgage-back securities (MBS) holdings to mature without rolling them over, will not completely offset the QE process. That means that the amount of reserves in the banking system are also structurally higher.

Additionally, the currency in circulation is a direct liability for the Fed. To preserve the integrity of the USD’s value, the assets held by the Fed are expected to be in high quality. However, the Fed’s approach to dealing with crises and slowdowns over the years has meant accepting collateral that was poorer in quality (including high yield corporate debt). Implicitly, that engenders a feeling that the assets held by the Fed are poorer in quality. At the margin, that fans the fears of USD debasement over the long-term.

U.S. Banking System Reserves Over Time

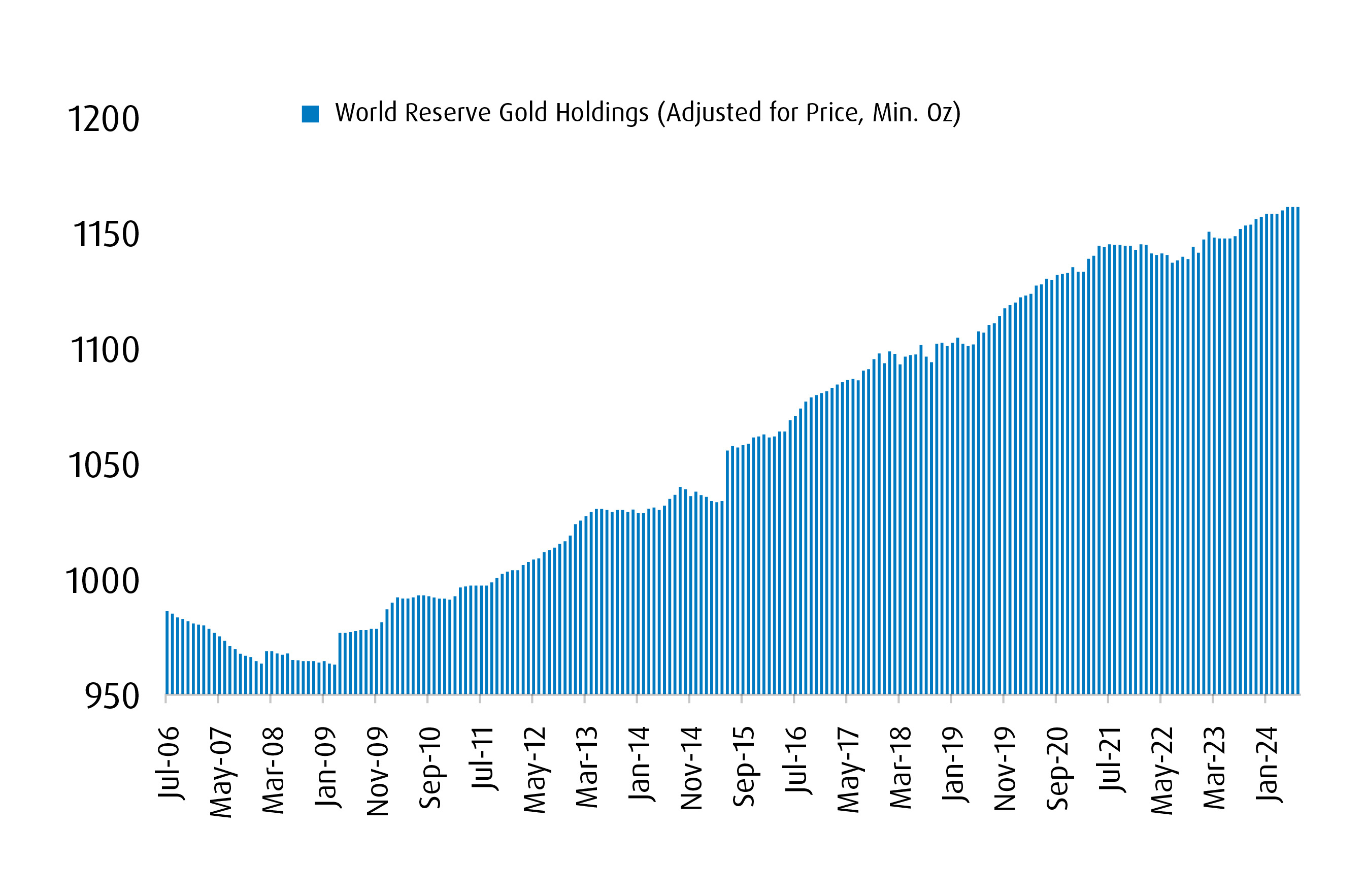

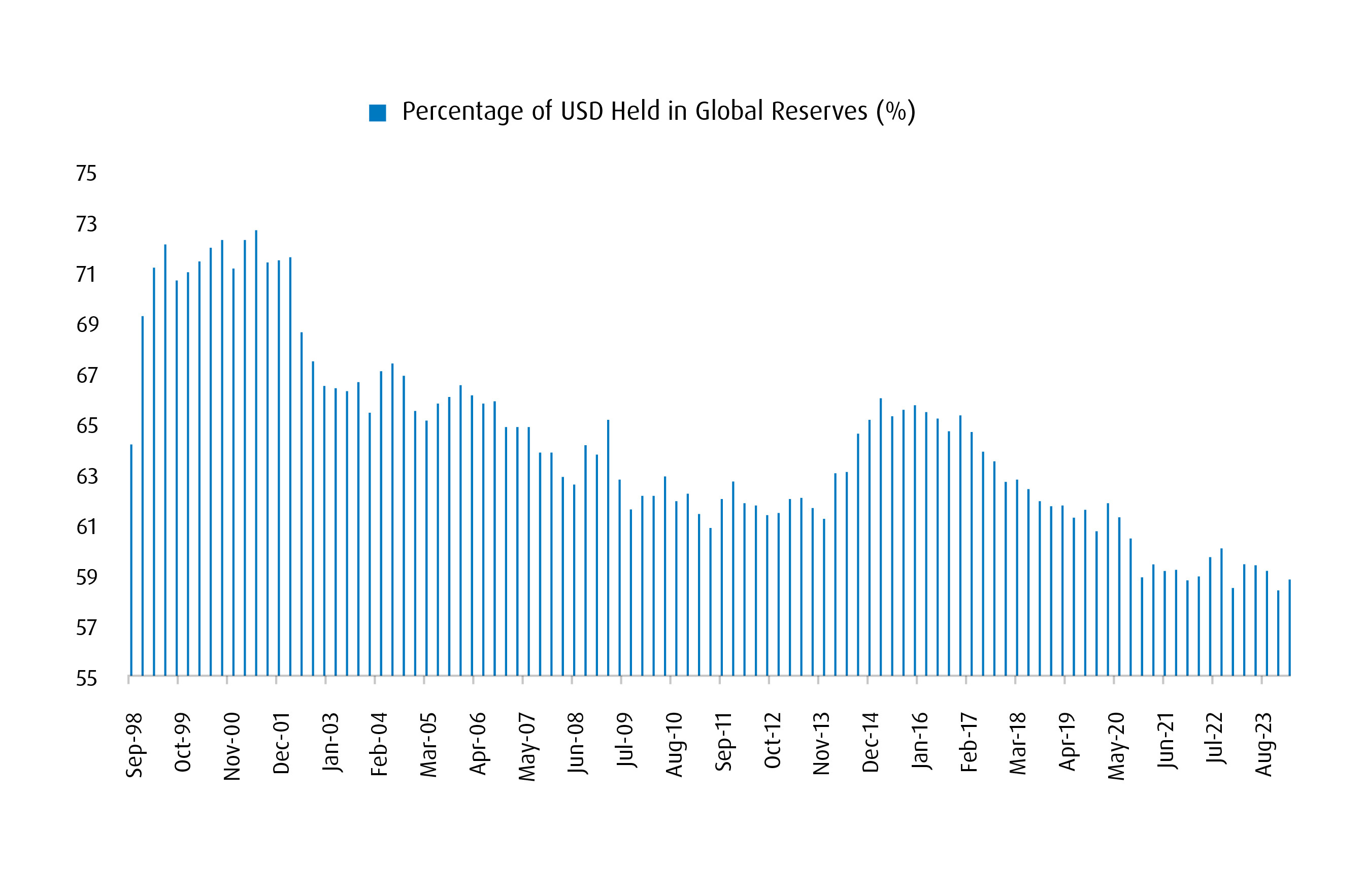

4. Central Bank Diversification Will Remain an Important Theme

We’re not of the view that the USD will lose its reserve currency status. Instead, the more likely scenario is that it will lose its sole reserve currency standing. This will largely result from the following:

- Overuse of sanctions as a political tool

- Sustained (and large) procyclical fiscal deficits in the U.S.

- A gradual shift towards alternatives as a medium-of-exchange (central bank digital currencies)

Already, we’ve seen countries that are less politically aligned with the U.S. (namely, China and Russia) increase their holdings of gold in reserve. This is expected to continue with other countries that have a large amount of foreign exchange reserves denominated in USD, making the shift as we head into a de-globalized world that is more multi-polar in nature.

Gold Reserves Increasing

Percentage of USD Held in Reserves Decreasing

5. Potential Threats to the USD From Persistent Deficits

Ahead of the U.S. election, neither Harris nor Trump are expected to run on a platform of budget consolidation. That’s a concern given that the current size of the deficit is close to the largest ever in peacetime.

Sustained budget deficits in a procyclical environment are generally bearish for the USD. That could feed into the debasement theme and cascade into additional momentum away from the USD in central bank reserve holdings.

The Bottom-Line

There are several compelling medium-to-long factors that support increasing exposure to gold. BMO’s Gold Bullion ETF (Ticker: ZGLD), which allow unitholders to get direct exposure to the price of gold bullion without having the hassle of buying and storing the precious metal, provides an appropriate ballast for portfolios while still allowing for some degree of outperformance.

1A statistical measure of how two securities move in relation to one another. Positive correlation indicates similar movements, up or down together, while negative correlation indicates opposite movements (when one rises, the other falls).

2 Market rate, as of August 15, 2024.

Advisor Use Only.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.