A Gameplan for the Trade War

Apr. 14, 2025- So here we are. Just a few short months after his inauguration, U.S. President Donald Trump has fired the opening salvo of a global trade war.

- While precise estimates on the new U.S. average effective tariff rate vary, there is broad consensus that it is well north of 20%. That is a stark difference from where it was a few months back (around 2-3%), and it signals a return for the U.S. to restrictive trade policies not seen since the days of the Great Depression just under a century ago.

- As the hub of the global commerce and finance network, the United States’ pivot towards higher trade and capital barriers represents a significant macroeconomic shock. And as a result, broad risk markets have come under a significant amount of pressure with the S&P 500 still 13% below its peak from earlier this year.

- From a sectoral perspective, the effects of the trade war are apparent. The tech sector has been the underperformer so far this year (Chart 1) – which is not surprising considering the aggregate revenue share that is generated outside of the United States (Chart 2). Indeed, we’ve also seen the street revise earnings lower for that sector by an appreciable degree (Chart 3).

- But our readers should also remember that a weaker trade backdrop will also truncate the time it takes for the U.S. economy to shift from expansion to slowdown. So as the tariff headlines fade, and real economic data point to weaker activity, defensive sectors should still provide some value. That suggests that Consumer Staples, Utilities and Health Care are worth keeping an eye on.

- We still sense that markets are underestimating the potential for a weaker earnings backdrop for other sectors. In particular, we think the market has more room to price in softer earnings for sectors like Materials, Communications as well as Consumer Discretionary.

Sectors We Like:

- Utilities - BMO SPDR Utilities Select Sector Index ETF (Ticker: ZXLU)

- Health care - BMO Health Care Select Sector Index ETF (Ticker: ZXLV)

- Financials - BMO SPDR Financials Select Sector Index ETF (Ticker: ZXLF)

Chart 1 – Returns by Sector

Chart 2 – Estimated Share of Revenues Generated Outside of the US

Chart 3 - Earnings and Valuation

Chart 4 – Seasonality Chart (Avg Return Over Past 35 Years)

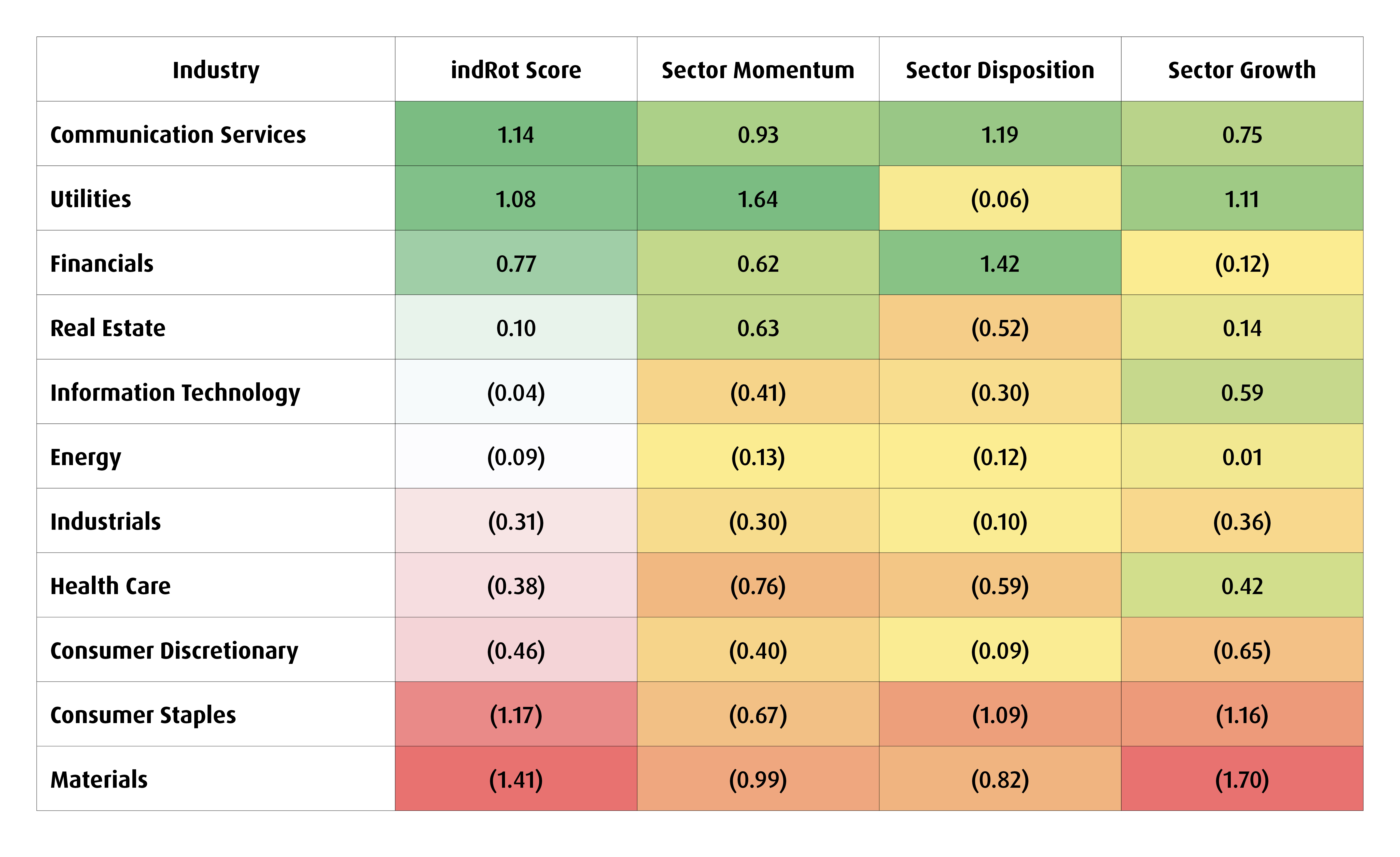

Chart 5 – BMO GAM Quant Model

Disclaimers:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

You cannot invest directly in an index.

Sector ETF products are also subject to sector risk and non-diversification risk, which generally will result in greater price fluctuations than the overall market.

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a“Select Sector SPDR ETF” or an“ETF” and collectively the“Select Sector SPDR ETFs” or the“ETFs”). Each Select Sector SPDR ETF is an“index fund” that invests in a particular sector or group of industries represented by a specified Select Sector Index. The companies included in each Select Sector Index are selected on the basis of general industry classification from a universe of companies defined by the S&P 500®. The investment objective of each ETF is to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in a particular sector or group of industries, as represented by a specified market sector index.

The S&P 500, SPDRs, and Select Sector SPDRs are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for use. The stocks included in each Select Sector Index were selected by the compilation agent. Their composition and weighting can be expected to differ to that in any similar indexes that are published by S&P.

The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks. The S&P 500 Index figures do not reflect any fees, expenses or taxes. An investor should consider investment objectives, risks, fees and expenses before investing.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.