The U.S. Economy Just Does it Better

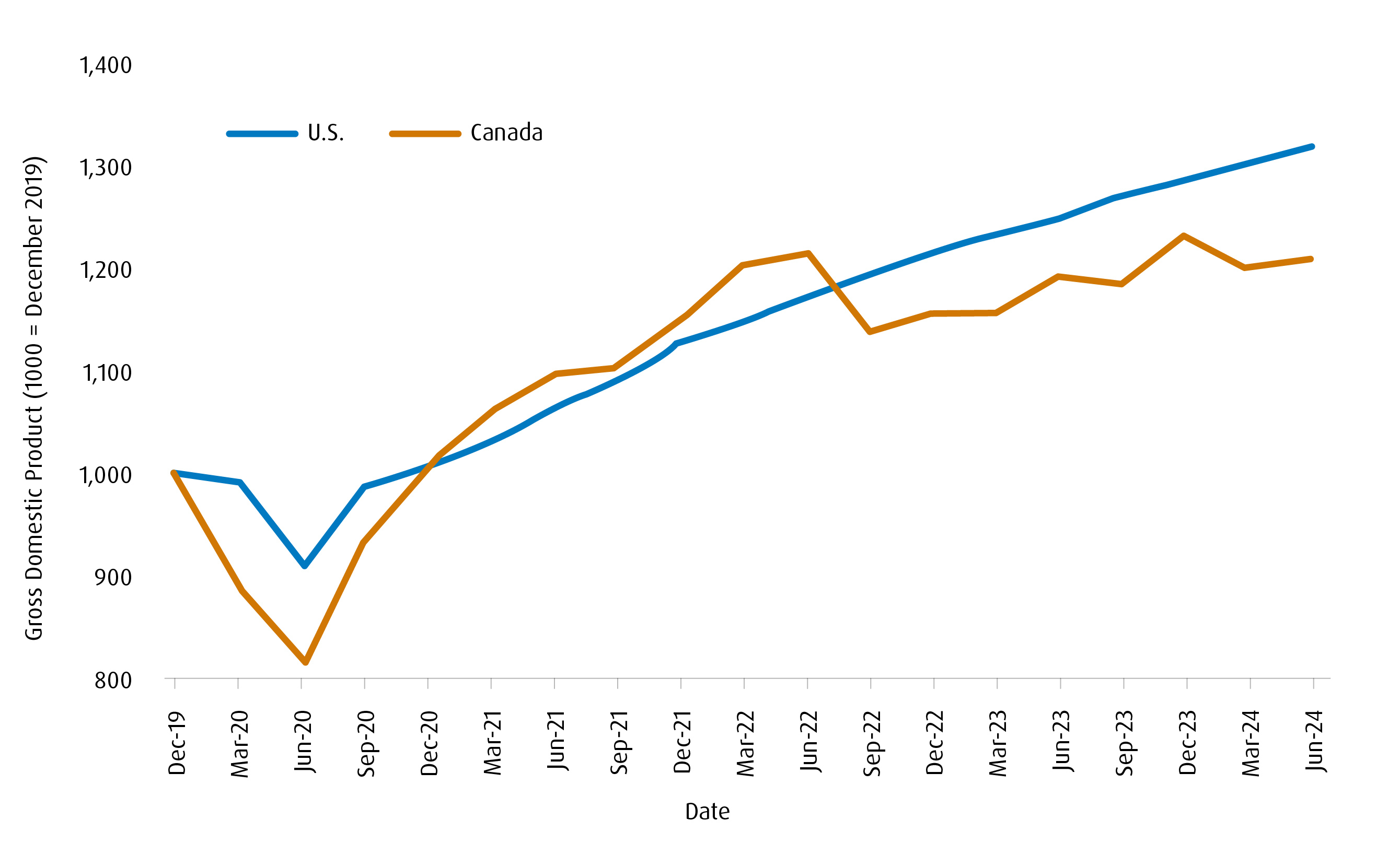

- In the last edition of this publication, we pondered whether the ‘soft landing’ narrative was still viable. After a few months of data, we can more resolutely state that it is – depending upon which economy we’re talking about.

- The U.S. economy still appears to be humming despite concerns with a slowing labour market. The Q3 data implies a growth rate of around 3% annualized, which is still above trend. The fact that this is happening at the same time that price pressures are decelerating suggests there is enough capacity in the economy to accommodate this degree of growth without stoking fresh inflationary fears. After a years-long battle with above-target inflation, this is a central banker’s dream scenario.

- Of course, the Fed is now much more attuned to the other side of its mandate – maintaining maximum sustainable employment. After all, the rationale behind the 50-basis point (bps) cut in September was that both sides of its mandate had come into better balance. By keeping policy settings at restrictive levels, the Fed was risking a more disorderly adjustment to the labour market. In hindsight, we still think that was the right call even if the September non-farm payrolls print was much stronger than expected. That’s primarily because we still see signs in other areas of the labour market that imply a backdrop that is slowing to a more normal pace – including job openings.

- From here, the cadence of rate cuts from the U.S. Federal Reserve (Fed) will come down to the speed of normalization in the jobs market. The potential base case scenario at this point is for 25-bps cuts until the Fed reaches its implied terminal of around 3.0%.

- We estimate that the U.S. labour market would need to add around 140,000−150,000 jobs per month to keep the unemployment rate steady. That’s not impossible to achieve in this environment, but it still portends to a degree a slowdown that doesn’t at all represent a hard landing scenario.

- The combination of a strong economy alongside looming rate cuts should be a powerful driver for U.S. Equities. We’ve reoriented our portfolio in favour of high-quality U.S. indices alongside small caps as we expect to see greater participation from that market segment during Equity rallies compared to earlier this year.

- In contrast, we’re a bit more circumspect when it comes to the Canadian economy. While we’re not yet at a point where we can definitively say that a ‘hard landing’ is the base case scenario, we do think the risks are sharper north of the border.

- True, the Q3 data implies that the Canadian economy recovered on the quarter. Having said that, we’re nowhere close to the Bank of Canada’s (BoC) own estimate of a 2.8% annualized rate of expansion. That suggests that despite the bounce in growth, the degree of economic slack should increase, which brings downside risk to the BoC’s inflation target into sharper relief.

- There’s a good chance that the BoC will have to expediate it’s move back to the neutral rate in the coming months via an outsized 50-bps cut. Additionally, we feel there’s also a decent chance that the central bank will have to take policy into stimulative territory and cut by more than the market is currently pricing in.

- Given the above, we continue to prefer Fixed Income exposure in Canada. The income generated closer to home complements the slightly more aggressive tilt to our Equity exposure which is mostly concentrated in the U.S.

- In terms of themes, we continue to expect a migration out of cash/money markets and into duration.1 That dovetails nicely with our expectation that dividend-focused strategies should outperform in the near-term. Additionally, we see upside in Canadian Investment Grade credit from spreads narrowing further to still attractive coupons.

Chart – A Comparison of U.S. and Canadian Growth (Indexed to Q4 2019)

Things to Keep an Eye On

a) We still expect the Fed to cut rates well into 2025. The cadence of those rate cuts (or whether they move by 25- or 50-bps increments) will come down to the speed of normalization for the U.S. labour market. We expect a more gradual normalization that points to 25-bps cuts being the base case scenario. The market is currently pricing in a 3.25% terminal interest rate for this easing cycle – a figure we think is a bit too high – which points to some further room for the front-end of the yield curve2 to outperform as the U.S. Treasury curve potentially normalizes. As part of this, we still like the BMO Short-Term US Treasury Bond Index ETF (Ticker: ZTS).

b) As central banks around the world (with the notable exception of the Bank of Japan) continue to ease policy rates, it’s worth remembering that the days of zero and/or negative interest rate policies are behind us. That means that the ‘income’ part of Fixed Income is now back in style while also providing some important diversification to Equity exposure. At the same time, a slowing inflation backdrop will bring back some enthusiasm for the traditional 60/40 portfolio.

Having said this, the rise of alternative assets and strategies over the past decade may provide an outlet for protecting downside to portfolios while remaining invested. For instance, exposure to long-short Equity strategies such as the BMO Long Short US Equity ETF (Ticker: ZLSU) would have improved a portfolio’s overall risk/return profile in the context of the early August sell-off.

Additionally, buffer ETFs like the BMO US Equity Buffer Hedged to CAD ETF – October (Ticker: ZOCT) provide ballast for portfolios. These ETFs help investors mitigate losses during periods of intense volatility,3 while also allowing some participation to the upside. Additionally, dividends paid from the underlying holdings are not subject to the downside buffer or the price cap.

Finally, exposure to gold via the BMO Gold Bullion ETF (Ticker: ZGLD) should reap benefits given its current favourability and low correlation to other assets.

c) The U.S. election is over and investors should be mindful of what could now play out. An electoral sweep (GOP won the presidency and both chambers) could bring more volatility relative to what’s priced into valuations currently.

We remain in an environment in which we expect to see high-quality Equities outperform as a factor. One of our largest exposures is the BMO MSCI USA High Quality Index ETF (Ticker: ZUQ).

Table 1 – U.S. Election Outcome

President | Trump |

| Congress | Red wave |

| Odds | 10.48% |

| Strategies | |

| Rationale | Onshoring + possible volatility + Fed encroachment |

Source: BMO Global Asset Management, as of September 30, 2024.

d) In China, we are mindful of the possibility that the bottom is likely in place for domestic Equities. Despite the piecemeal attempts to boost the economy via fiscal spending, the launch of new Equity facilities by the People’s Bank of China (PBoC) are aimed at encouraging domestic investors to buy more Chinese stocks while also promoting share buybacks by firms. True, Equities have rallied fairly aggressively since the news but we still expect additional upside risk from here. Our preference is to leverage the degree of exposure to the Chinese market via the BMO MSCI Emerging Markets Index ETF (Ticker: ZEM). This Fund also provides exposure to other growth markets that we think can outperform – including India and South Korea.

Changes to Portfolio Strategy*

Buy/Add |

Ticker |

Old weight |

% |

New weight |

9% |

1% |

10% |

||

0% |

8% |

8% |

||

0% |

5% |

5% |

||

0% |

2% |

2% |

||

12% |

3% |

15% |

||

0% |

10% |

10% |

||

0% |

5% |

5% |

||

0% |

5% |

5% |

||

0% |

5% |

5% |

||

3% |

1% |

4% |

||

0% |

3% |

3% |

||

0% |

3% |

3% |

As of September 30, 2024. Model portfolio for illustrative purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. These are not recommendations to buy or sell any particular security. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

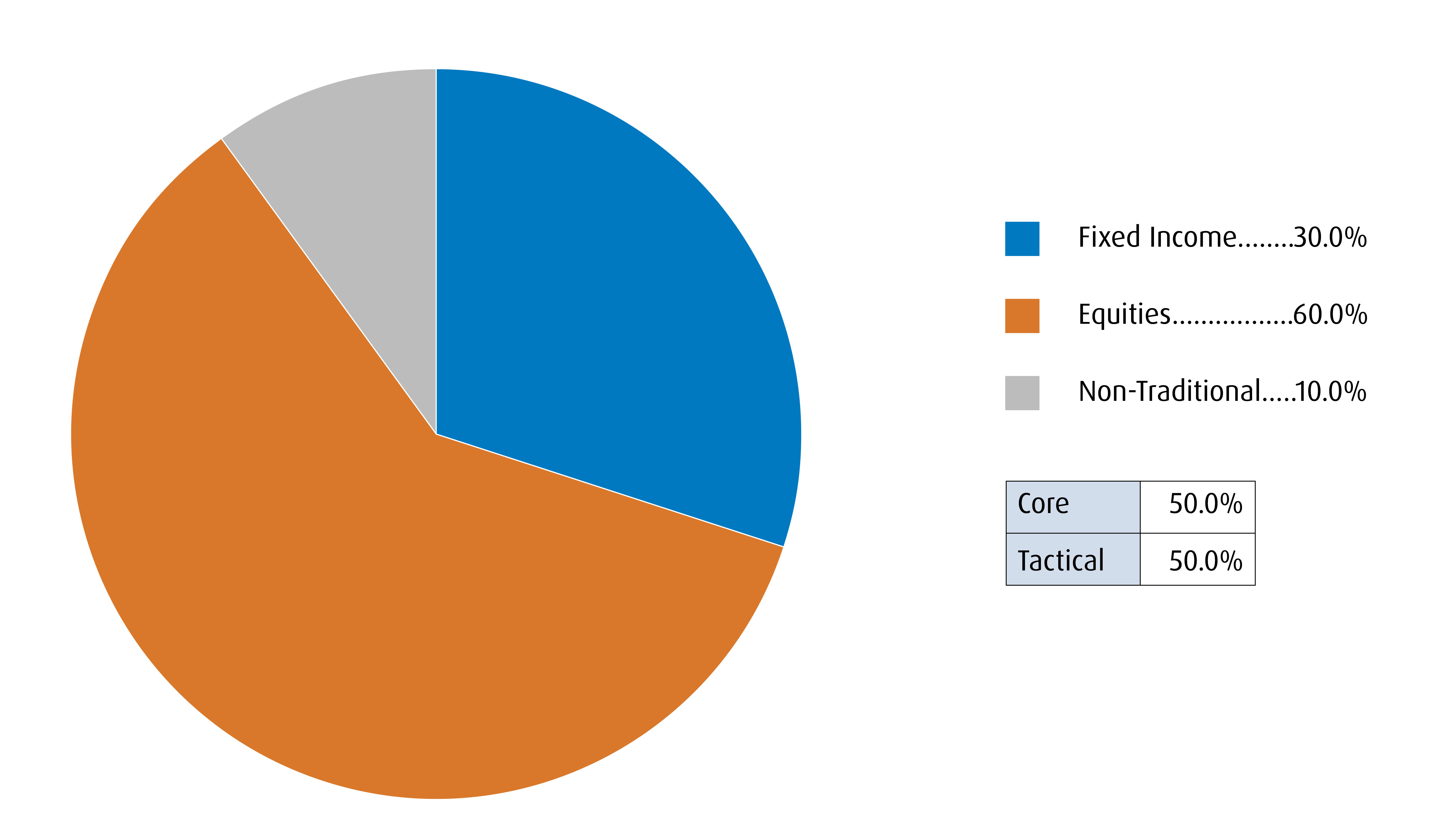

Asset Allocation:

- We’re adopting a less defensive posture for our balanced portfolio from here. Indeed, the composition of our portfolio has now shifted towards a 60% allocation to Equities (focused primarily on the U.S.). This is because we see the backdrop of the U.S. economy alongside further Fed rate cuts as a supportive environment for U.S. assets. Performance in the Equity market should continue to broaden out to small cap stocks, while dividend and quality remain our preferred factors.

- We’ve pared our Fixed Income exposure somewhat. This is largely because we feel long-end U.S. yields are more or less fairly valued. Indeed, long-term real yields are consistent with where equilibrium U.S. growth is likely to be while breakevens are now implying that the U.S. economy will average 2% inflation over the long haul.4

- However, we continue to like duration in Canada. We expect the BoC to continue to ease and eventually take rates into stimulative territory as downside risks to the inflation target come into sharper relief.

Equities:

- In keeping with the slightly more aggressive tilt (relative to our prior report), we’ve pared our exposure to low-volatility Equity strategies in both the U.S. and Canada (ZLU and ZLB) to a degree, while adding new exposure to small cap tracking funds (BMO S&P US Small Cap Index ETF, Ticker: ZSML).

- In an environment of falling rates, we continue to like dividend focused strategies. As such, we’ve added the BMO US Dividend ETF (Ticker: ZDY).

- For regional diversification, we’ve also added the BMO MSCI EAFE Index ETF (Ticker: ZEA) as well as ZEM. The latter should also perform if we’re correct in our assessment that Chinese markets have further upside from here.

- We’ve exited our sector-based strategies (both ZEO and ZEB) as we don’t see scope for further outperformance from here.

Fixed Income:

- One theme that we envisage playing out further is the migration from cash/money markets and into duration. We see this playing out much more in the Canadian market – where we continue to like owning spread-based products (corporates).

- As such, we’ve exited our positions in ZST, ZTIP.F, and ZSU. We’re not as optimistic on U.S.-based duration at this point, but prefer corporate exposure via the BMO High Yield US Corporate Bond Hedged to CAD Index ETF (Ticker: ZHY).

- For Canada, we’ve added exposure to CAD corporates via the BMO Mid Corporate Bond Index ETF (Ticker: ZCM) as well as a small satellite position in the BMO Long Federal Bond Index ETF (Ticker: ZFL).

- We’re increasing our exposure slightly to the BMO Discount Bond Index ETF (Ticker: ZDB). This provides the same duration and yield-to-maturity as the ZAG but is more tax-efficient.

Non-Traditional/Hybrids:

- We’ve maintained the overall weight for this sleeve of the portfolio at 10%.

- We’ve removed our exposure to the ZPR, and instead elected to replace it with ZGLD.Put simply, we feel this provides our portfolio with a bit more support given the growth tilt.

- We’ve also elected to switch out of ZJUL and into ZOCT.

Balanced Portfolio for Q4 2024

Investment Objective and Strategy:

The strategy involves tactically allocating to multiple asset-classes and geographies to achieve long-term capital appreciation and total return by investing primarily in ETFs

| Ticker | ETF Name | Sector | Positioning | Price | Management Fee* | Weight (%) | 90-Day Volatility | Volatility Contribution | Annualized Distribution Yield (%)** | Yield/Volatility†† |

|---|---|---|---|---|---|---|---|---|---|---|

| Fixed Income | ||||||||||

| ZDB | BMO Discount Bond Index ETF | Fixed Income | Core | $15.01 | 0.09% | 10.0% | 5.41% | 5.09% | 2.36% | 0.44 |

| ZTS | BMO Short-Term US Treasury Bond Index ETF | Fixed Income | Tactical | $50.44 | 0.20% | 5.0% | 4.51% | 2.12% | 2.22% | 0.49 |

| ZCM | BMO Mid Corporate Bond Index ETF | Fixed Income | Tactical | $15.45 | 0.30% | 8.0% | 3.05% | 2.30% | 3.85% | 1.26 |

| ZHY | BMO High Yield US Corporate Bond - Hedged to CAD Index ETF | Fixed Income | Tactical | $11.32 | 0.55% | 5.0% | 5.70% | 2.68% | 5.88% | 1.03 |

| ZFL | BMO Long Federal Bond Index ETF | Fixed Income | Tactical | $13.02 | 0,20% | 2.0% | 12.48% | 2.35% | 2.92% | 0.23 |

| Total Fixed Income | 30.0% | 14.53% | ||||||||

| Equities | ||||||||||

| ZUQ | BMO MSCI USA High Quality Index ETF | Equity | Core | $86.61 | 0.30% | 15.00% | 13.98% | 19.73% | 0.67% | 0.05 |

| ZLB | BMO Low Volatility Canadian Equity ETF | Equity | Core | $48.05 | 0.35% | 15.00% | 8.29% | 11.69% | 2.32% | 0.28 |

| ZLU | BMO Low Volatility US Equity ETF | Equity | Core | $55.08 | 0.30% | 5.00% | 9.56% | 4.50% | 1.98% | 0.21 |

| ZSML | BMO S&P US Small Cap Index ETF | Equity | Core | $42.31 | 0.20% | 10.00% | 20.17% | 18.97% | 1.24% | 0.06 |

| ZDY | BMO US Dividend ETF | Equity | Tactical | $45.58 | 0.30% | 5.00% | 9.74% | 4.58% | 2.17% | 0.22 |

| ZEA | BMO MSCI EAFE Index ETF | Equity | Tactical | $23.82 | 0.20% | 5.00% | 13.35% | 6.28% | 2.71% | 0.20 |

| ZEM | BMO MSCI Emerging Markets Index ETF | Equity | Tactical | $23.03 | 0.25% | 5.00% | 16.88% | 7.94% | 2.56% | 0.15 |

| Total Equity | 60.0% | 73.69% | ||||||||

| Non-Traditional Hybrids | ||||||||||

| ZLSU | BMO Long Short US Equity ETF | Hybrid | Tactical | $38.33 | 0.65% | 4.00% | 13.28% | 5.00% | 1.81% | 0.14 |

| ZOCT | BMO US Equity Buffer Hedged to CAD ETF – October | Hybrid | Tactical | $32.94 | 0.65% | 3.00% | 2.48% | 0.70% | ||

| ZGLD | BMO Gold Bullion ETF | Hybrid | Tactical | $39.39 | 0.20% | 3.00% | 21.57% | 6.09% | ||

| Total Alternatives | 10.00% | 11.78% | ||||||||

| Total Cash | 0.00% | 0.00 | 0.00% | 0.00 | ||||||

| Portfolio | 0.29% | 100.0% | 10.63% | 100.00% | 2.12% | 0.20 |

As of September 30, 2024. Model portfolio for illustrative purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. These are not recommendations to buy or sell any particular security. Particular investments and/or trading strategies should be evaluated relative to the individual’s risk profile and investment objectives. Professional advice should be obtained with respect to any circumstance.

** This yield is calculated by taking the most recent regular distribution, or expected distribution, (excluding additional year end distributions) annualized for frequency, divided by current NAV. The yield calculation does not include reinvested distributions.

*** Yield calculations for bonds are based on yield to maturity, including coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity and. For Equities, it is based on the most recent annualized income received divided by the market value of the investments. Please note yields of Equities will change from month to month based on market conditions. The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Portfolio Holdings

| Ticker | Name | Weight | Country |

| ZDB | BMO Discount Bond Index ETF | 10.00% | Canada |

| ZTS | BMO Short-Term U.S. Treasury Bond Index ETF | 5.00% | U.S. |

| ZCM | BMO Mid Corporate Bond Index ETF | 8.00% | Canada |

| ZHY | BMO High Yield U.S. Corporate Bond - Hedged to CAD Index ETF | 5.00% | U.S. |

| ZFL | BMO Long Federal Bond Index ETF | 2.00% | Canada |

| ZUQ | BMO MSCI USA High Quality Index ETF | 15.00% | U.S. |

| ZLB | BMO Low Volatility Canadian Equity ETF | 15.00% | Canada |

| ZLU | BMO Low Volatility U.S. Equity ETF | 5.00% | U.S. |

| ZSML | BMO S&P U.S. Small Cap Index ETF | 10.00% | U.S. |

| ZDY | BMO U.S. Dividend ETF | 5.00% | U.S. |

| ZEA | BMO MSCI EAFE Index ETF | 5.00% | International |

| ZEM | BMO MSCI Emerging Markets Index ETF | 5.00% | International |

| ZLSU | BMO Long Short U.S. Equity ETF | 4.00% | U.S. |

| ZOCT | BMO US Equity Buffer Hedged to CAD ETF – October | 3.00% | U.S. |

| ZGLD | BMO Gold Bullion ETF | 3.00% | Other |

| Total | 100.00% | ||

Model portfolio for illustrative purposes only, as of September 30, 2024. |

Portfolio Characteristics

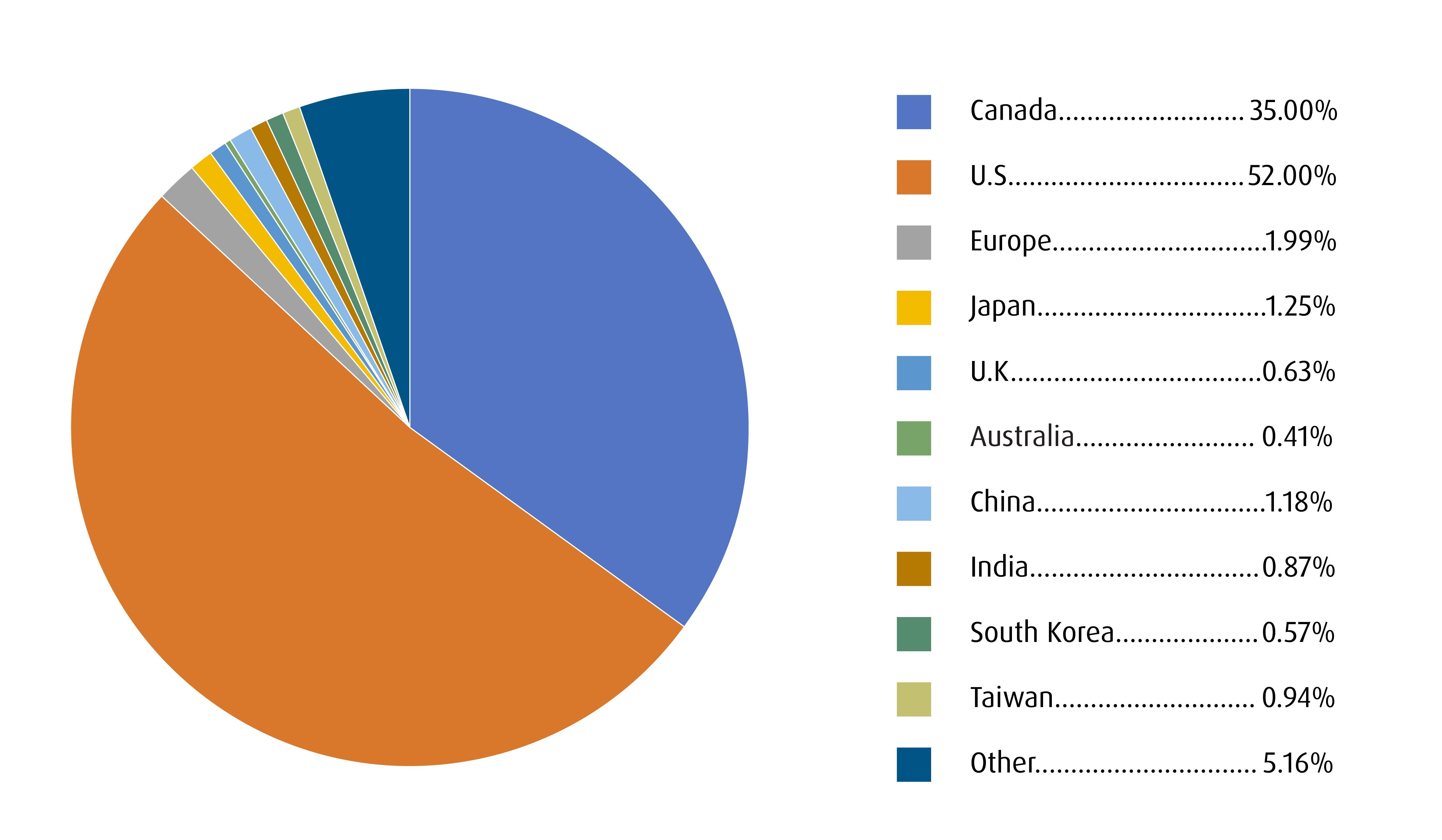

Regional Breakdown (Overall Portfolio)

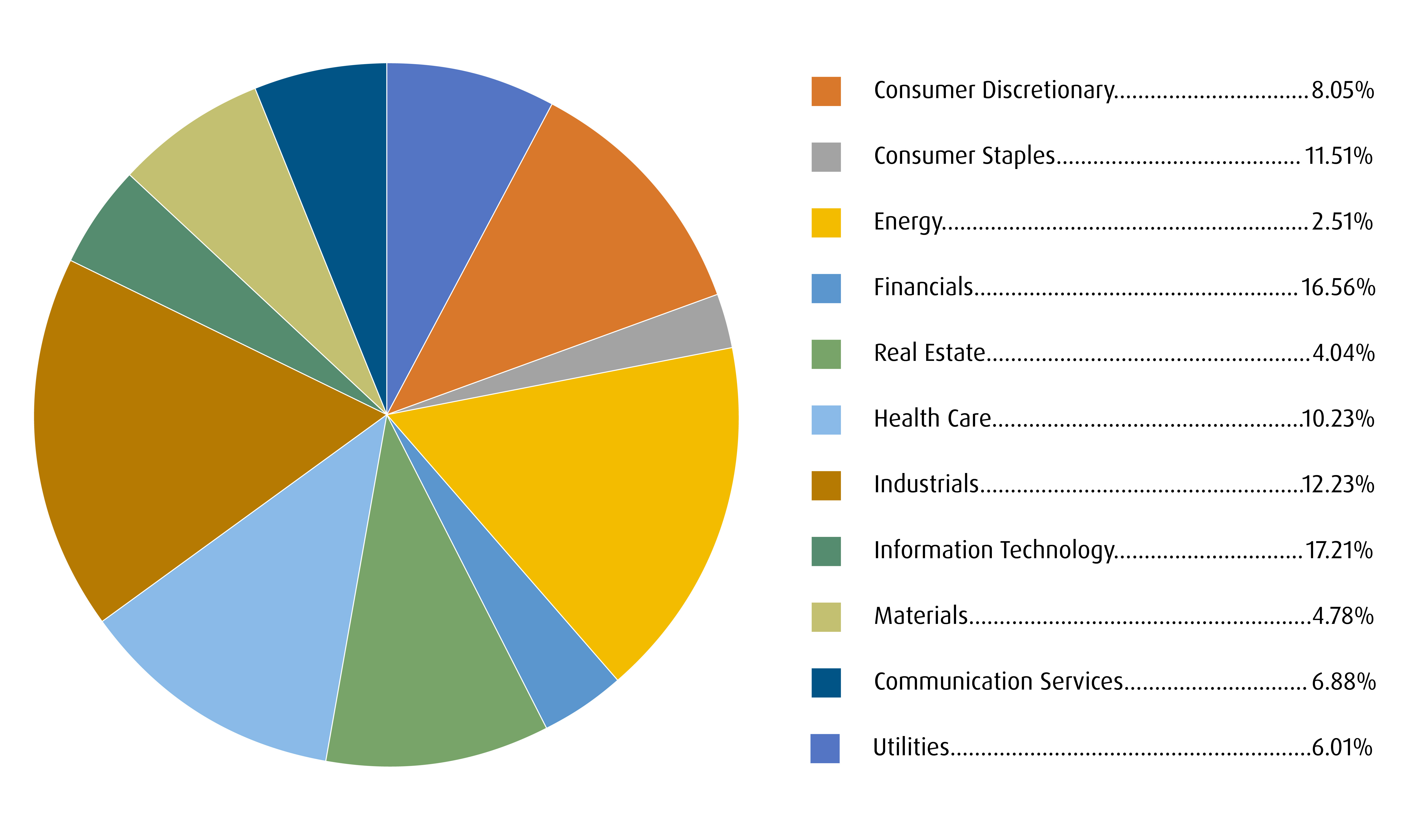

Equity Sector Breakdown

Fixed Income Sector Breakdown5

Federal |

36.7% |

Weighted Average Term |

8.08 |

Provincial |

11.1% |

Weighted Average Duration |

6.14 |

Corporate |

51.6% |

Weighted Average Coupon (%) |

3.63 |

Municipal |

0.6% |

Annualized Distribution Yield (%) |

3.40 |

| Weighted Average Yield to Maturity (%) | 4.22 |

As of September 30, 2024.

Visit bmo.com/etfs or contact Client Services at 1−800−361−1392.

To listen to our Views From the Desk BMO ETF Podcasts, please visit bmoetfs.ca.

BMO ETF Podcasts are also available on

Standard Performance Data

Fund Performance |

1 Month |

3 Month |

1 Year |

2 Year |

3 Year |

5 Year |

Since Inception |

Inception Date |

1.95 |

4.70 |

12.98 |

5.52 |

-0.28 |

0.67 |

2.34 |

2/14/2014 |

|

1.20 |

2.18 |

6.77 |

3.41 |

2.67 |

1.41 |

1.55 |

2/28/2017 |

|

2.30 |

5.52 |

16.10 |

8.23 |

1.23 |

2.32 |

4.13 |

1/21/2010 |

|

1.36 |

4.70 |

14.20 |

11.62 |

1.60 |

2.69 |

4.83 |

10/26/2009 |

|

2.71 |

6.23 |

17.14 |

2.78 |

-4.60 |

-3.64 |

2.57 |

5/25/2010 |

|

1.28 |

3.57 |

38.49 |

34.20 |

15.37 |

17.99 |

16.81 |

11/12/2014 |

|

3.15 |

12.02 |

27.43 |

16.67 |

10.68 |

9.89 |

12.28 |

10/27/2011 |

|

2.33 |

11.25 |

25.31 |

12.37 |

11.83 |

9.26 |

14.01 |

3/27/2013 |

|

1.17 |

8.72 |

24.76 |

15.93 |

5.80 |

- |

9.06 |

2/11/2020 |

|

2.21 |

8.39 |

27.41 |

18.47 |

12.30 |

9.36 |

13.12 |

3/27/2013 |

|

1.02 |

5.91 |

24.28 |

23.95 |

7.76 |

8.44 |

7.41 |

2/14/2014 |

|

6.05 |

7.07 |

23.91 |

16.34 |

1.74 |

5.76 |

4.86 |

10/26/2009 |

|

1.40 |

2.37 |

27.02 |

- |

- |

- |

- |

9/26/2023 |

|

- |

- |

- |

- |

- |

- |

- |

9/26/2023 |

|

- |

- |

- |

- |

- |

- |

- |

2/15/2024 |

Bloomberg, BMO Asset Management Inc., as of September 30, 2024.

1 A measure of the sensitivity of the price of a Fixed Income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise).

2 Yield Curve: A line that plots the interest rates of bonds having equal credit quality but differing maturity dates. A normal or steep yield curve indicates that long-term interest rates are higher than short-term interest rates. A flat yield curve indicates that short-term rates are in line with long-term rates, whereas an inverted yield curve indicates that short-term rates are higher than long-term rates.

3 Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

4 Breakeven Rate: The difference in yield between inflation-protected and nominal debt of the same maturity. If the breakeven rate is negative, it suggests traders are betting the economy may face deflation in the near future

5 Weighted Average Term: The average time it takes for bonds to mature in a Fixed Income portfolio.

Weighted Average Current Yield: The market value-weighted average coupon divided by the weighted average market price of bonds.

The market value-weighted average yield to maturity includes coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

Weighted Average Duration: The market value-weighted average duration of underlying bonds divided by the weighted average market price of the underlying bonds. Duration is a measure of a bond’s sensitivity to changes in interest rates. It is expressed in years and helps investors understand how much the price of a bond is likely to change when interest rates move. Essentially, duration estimates the percentage change in a bond’s price for a 1% change in interest rates.

Weighted Average Coupon: The average interest received by a bond investor, expressed on a nominal annual basis.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Disclaimers

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The ETFs referred to herein are not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to an ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship that MSCI has with the Manager and any related ETF.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by month end net asset value (NAV). The yield calculation does not include reinvested distributions. Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and NAV fluctuations. The payment of distributions should not be confused with the BMO ETF’s performance, rate of return or yield. If distributions paid by a BMO ETF are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO ETF, and income and dividends earned by a BMO ETF, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter, or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see the distribution policy in the BMO ETFs’ prospectus.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.