BMO ETFs Guided Portfolio: Quarterly Fixed Income Strategy (Q4 2024)

Oct. 24, 2024In this report, we highlight our fixed income positioning strategies for the third quarter.

Duration

- The U.S. Federal Reserve (Fed) kicked off its easing cycle with a bang, cutting rates by 50 basis points (bps) at its September 2024 meeting. As such, the target range for the Fed funds rate is now between 4.75% and 5.00%.

- The reason for the “non-standard size” (larger than usual) cut was primarily because the Fed feels that both sides of its dual mandate (maintaining maximum employment and controlling inflation) are now coming into better balance. Having been on hold for 14 months at very restrictive policy settings, the Fed felt that it needed to expedite the move towards a more appropriate range for policy rates that is closer to neutral.

- As expected, the Fed’s move led the U.S. Treasury curve to steepen – albeit in a curious fashion. As such, this steepening has been led by long-end yields rising by more than the front-end (a “bear steepening” move).1 That’s atypical, as traditional steepening moves following the initial Fed rate cut at the start of an easing cycle have typically been led by the front-end moving lower by more than the long-end (or a “bull steepening” move).

- Why has this happened? The key is to look at the two main components of the 10-year nominal yield (real yields and breakevens) to extract the meaning behind the shift. For instance, since the Fed meeting on September 18, 2024 the nominal U.S. 10-year yield has increased by around 42 bps. In that time, the 10-year real yield has increased by 20 bps, which means that 10-year breakevens (or the difference between nominal and real yields2) have increased by 22 bps.

- Regular readers of ours are aware that we tend to look at long-term real yields as a market proxy of the equilibrium growth rate of the U.S. As such, one way to interpret the move higher is that the market saw the 50-bps cut as a signal that the Fed wouldn’t be too relaxed with respect to a slowing labor backdrop and what it would mean for growth over the long-term. As such, the risk of a hard landing had to be re-priced.

- The same thinking is likely behind the extension higher in 10-year breakevens, as well – with the additional kicker being that oil prices have rallied as well due to other factors. Indeed, the market is paying tribute to the potential passthrough from oil and higher equilibrium growth in the U.S. to long-term inflation.

- Since the Federal Open Market Committee (FOMC) meeting, we’ve had generally favourable data in the U.S. that suggests that the base case is for 25-bps cuts for both the November 2024 and December 2024 meetings (which the market has priced in). The forward Overnight Index Swap (OIS) market is now implying a neutral rate of 3.25% for the Fed and we’d argue that the risks to that estimate are to the downside (closer to 3.00%).3

- Also, we’re of the view that the shift higher in long-end breakevens is close to an end here. Indeed, the recent trend in Consumer Price Index (CPI) and Producer Price Index (PPI) prints tells us that price pressures are slowing in the U.S. for now. At the same time, 10-year real yields look to be consolidating after digesting the recent spate of data.

- What this means is that while we continue to expect the U.S. Treasury yield curve to steepen, we suspect that the front-end should drive the move more in the period ahead.4

- The spillover effects matter for the Canadian dollar (CAD) market, as well – which has bear-steepened alongside the U.S. curve thus far. Nevertheless, we expect the bull-steepening move in Canada to be a bit more pronounced going forward. That’s largely because of a weaker backdrop in Canada that should lead the Bank of Canada (BoC) to ease by more than the market is currently pricing in for this cycle (which is around 150 bps).

- Indeed, given the degree of economic slack that is opening up in the Canadian economy (as evidenced by the most recent BoC quarterly surveys), we think that the Bank will take policy rates into stimulative territory as the easing cycle progresses. Our estimate is at least another 200 bps worth of easing left. Again, that should take the front-end CAD yields lower.

- What does this mean for our portfolio? In broad strokes, we like owning duration5 far more in Canada than in the U.S.

Credit

- Credit spreads have continued to tighten on both sides of the border with U.S. Investment Grade (IG) spreads now in line with where they were before the start of the hiking cycle. Additionally, U.S. IG spreads are now well below long-term averages, implying that momentum from further tightening should ebb somewhat going forward.6

- We see further room for CAD credit spreads to tighten – not least because we expect further BoC rate cuts in the coming year while reduced term premiums should help issuers that are looking to refinance or carrying large debt burdens.

- Nevertheless, for Canadian investors, we’d still recommend keeping a satellite position in U.S. corporates. The reason being that current yields are still fairly attractive while also providing diversification benefits.

Currency:

- We continue to see USD/CAD tracking within the 1.3400−1.3850 range for the time being. The risks to that view remain skewed towards the topside of that range (implying more CAD weakness) due to the fact that we think the market is underpricing risks that the BoC may need to ease by more than the Fed.

- Given the above, our preference is to veer towards increasing foreign exchange (FX) risk – but that remains coloured by correlations between the USD and underlying exposures. For instance, in cases where the USD is negatively7 correlated with the underlying asset, there is a diversification benefit by taking on FX risk. The opposite is true if the USD is positively correlated with the underlying (implying that you can hedge FX risk in the latter scenario).

- Interestingly enough, USD/CAD is positively correlated to the performance of the U.S. High Yield Index. As such, our preference is to hedge FX risk and incorporate ZHY instead of ZJK.

Model Portfolio

| Ticker | ETF Name | Weight | Duration | Weighted Avg YTM | Management Fee | Exposure | Positioning |

| ZAG | BMO Aggregate Bond Index ETF | 35.0% | 7.38 | 3.48% | 0.08% | Canada | Core |

| ZDB | BMO Discount Bond Index ETF | 25.0% | 7.32 | 3.39% | 0.09% | Canada | Core |

| ZPR | BMO Laddered Preferred Share Index ETF | 10.0% | 2.86 | 7.17% | 0.45% | Canada | Core |

| ZCM | BMO Mid Corporate Bond Index ETF | 10.0% | 5.92 | 4.23% | 0.30% | Canada | Non-Traditional |

| ZHY | BMO High Yield US Corporate Bond - Hedged to CAD Index ETF | 10.0% | 2.95 | 6.93% | 0.55% | United States | Non-Traditional |

| ZTS | BMO Short-Term US Treasury Bond Index ETF | 5.0% | 2.61 | 3.57% | 0.20% | United States | Non-Traditional |

| ZFH | BMO Floating Rate High Yield ETF | 5.0% | 0.21 | 6.95% | 0.40% | United States | Non-Traditional |

BMO Global Asset Management. For illustrative purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Source: Bloomberg, BMO Asset Management Inc., as of October 14, 2024. These are not recommendations to buy or sell any particular security. Particular investments and/or trading strategies should be evaluated relative to the individual’s risk profile and investment objectives. Professional advice should be obtained with respect to any circumstance.

Fund Performance

Fund Performance (%) |

1 Month |

3 Month |

1 Year |

2 Year |

3 Year |

5 Year |

Since Inception |

Inception Date |

1.92 |

4.66 |

12.90 |

5.50 |

-0.17 |

0.55 |

2.90 |

January 19, 2010 |

|

1.95 |

4.70 |

12.98 |

5.52 |

-0.28 |

0.67 |

2.34 |

February 10, 2014 |

|

0.54 |

4.61 |

30.60 |

11.72 |

2.84 |

7.82 |

2.09 |

November 14, 2012 |

|

2.30 |

5.52 |

16.10 |

8.23 |

1.23 |

2.32 |

4.13 |

January 19, 2010 |

|

1.36 |

4.70 |

14.20 |

11.62 |

1.60 |

2.69 |

4.83 |

October 20, 2009 |

|

1.20 |

2.18 |

6.77 |

3.41 |

2.67 |

1.41 |

1.55 |

February 28, 2017 |

|

1.26 |

3.50 |

15.19 |

14.66 |

7.52 |

4.96 |

5.12 |

February 10, 2014 |

As of September 30, 2024.

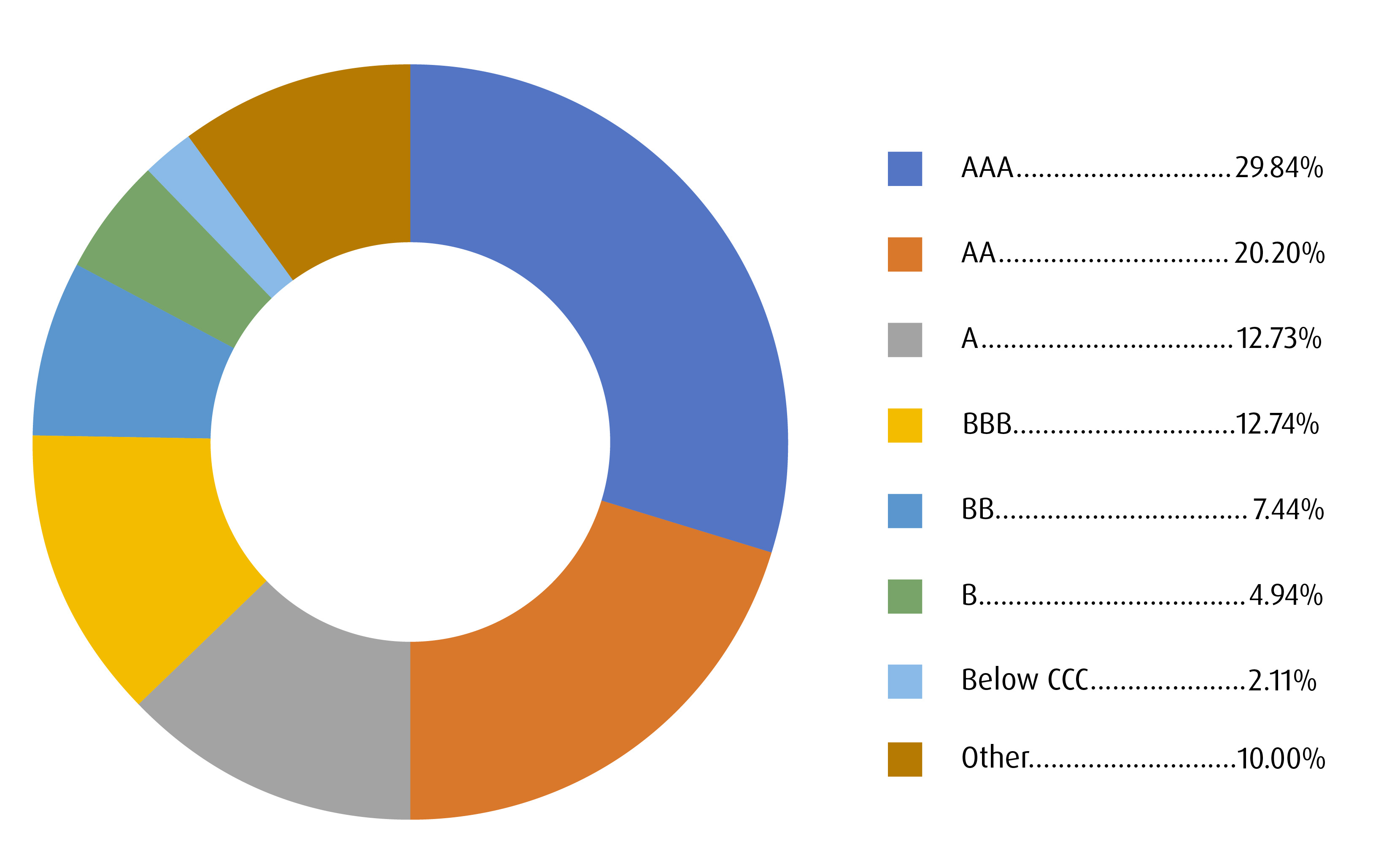

Credit Summary

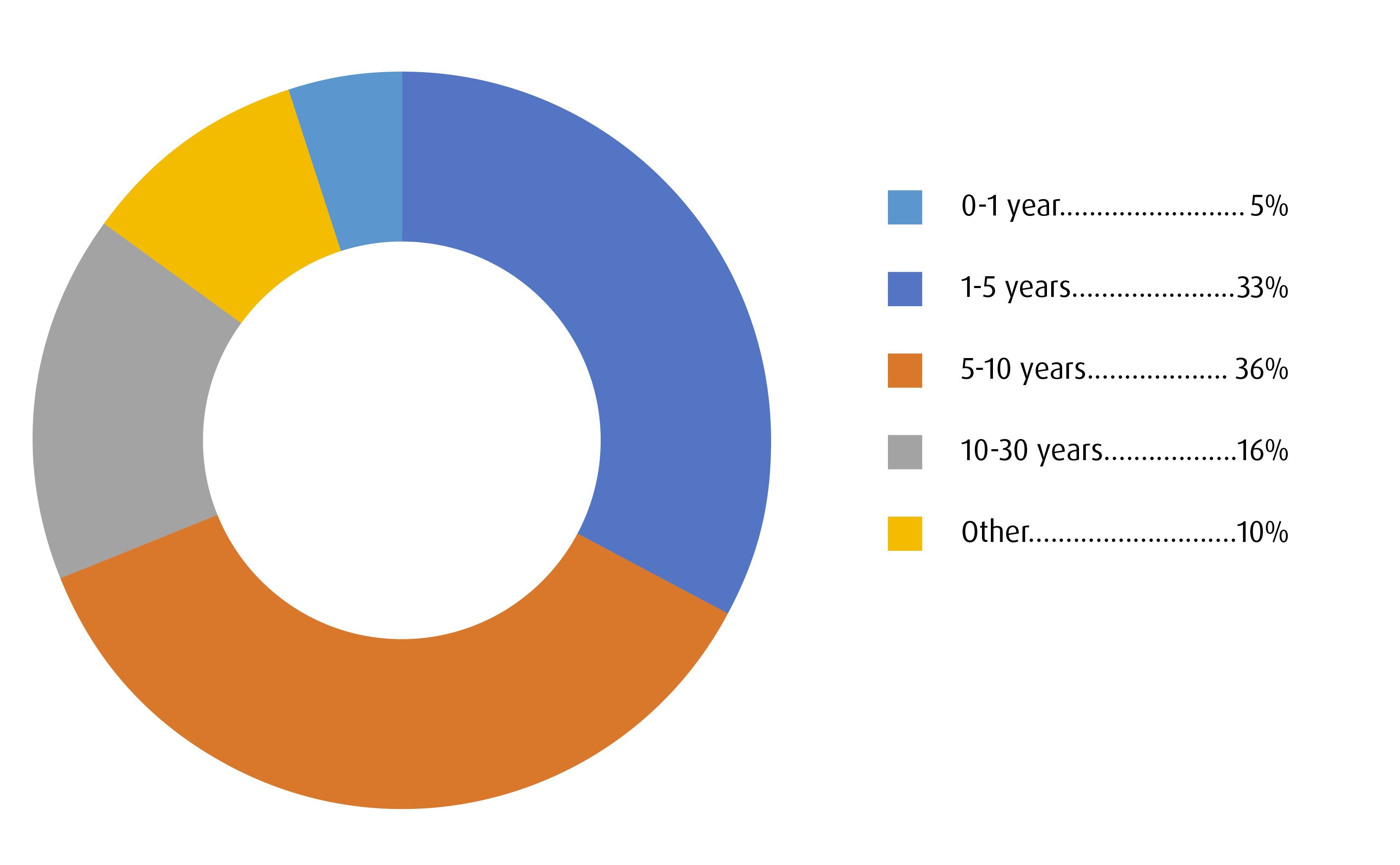

Term Summary

Weighted Average Yield to Maturity: The market value weighted average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

**Please note the ‘Other’ category refers to the weight of ZPR in the portfolio.

Visit bmo.com/etfs or contact Client Services at 1−800−361−1392.

To listen to our Views From the Desk Podcast, please visit bmoetfs.ca.

BMO ETF Podcasts are also available on

1 A “bear steepener” is the widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

2 Breakeven Rate: The difference in yield between inflation-protected and nominal debt of the same maturity. If the breakeven rate is negative, it suggests traders are betting the economy may face deflation in the near future.

3 An overnight index swap is an interest rate swap in which a fixed rate is exchanged for an overnight floating rate. The OIS market is used to gauge future interest rate moves.

4 Yield Curve: A line that plots the interest rates of bonds having equal credit quality but differing maturity dates. A normal or steep yield curve indicates that long-term interest rates are higher than short-term interest rates. A flat yield curve indicates that short-term rates are in line with long-term rates, whereas an inverted yield curve indicates that short-term rates are higher than long-term rates.

5 Duration: A measure of the sensitivity of the price of a Fixed Income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise).

6 Credit Risk: An assessment of the creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation. Credit risk is the risk of default on a debt that may arise from a borrower failing to make required payment. A credit spread is the measure of the difference in yields between two debt securities that mature simultaneously but have different risks.

7 Correlation: A statistical measure of how two securities move in relation to one another. Positive correlation indicates similar movements, up or down together, while negative correlation indicates opposite movements (when one rises, the other falls).

Disclaimers

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors cannot invest directly in an index.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.