Sales aid: BMO Global Agriculture ETF – ZEAT

Jan. 25, 2023Why ZEAT and how to utilize

1. Inflation: A large component of recent inflation readings around the world are driven by increased food prices. Investing in ZEAT provides exposure to companies that are directly involved in the production process; these types of companies can easily pass on costs to consumers which can serve as a good hedge against inflation.

2. Food security: An ongoing risk for the world today is that of food shortages, driven by droughts in many regions, changes in farming practices, climate change, population growth and ongoing conflict in Ukraine. These challenges around the world are increasing the demand for agricultural company’s services and production.

3. Long Term Capital Appreciation: ZEAT provides a concentrated exposure to the largest global companies that produce or are involved with the production of necessities. Broad market strategies have very little exposure to agriculture and food-related companies. With food prices skyrocketing, the broad market is less exposed to companies that benefit from such a trend; ZEAT is well positioned to deliver performance given its allocation.

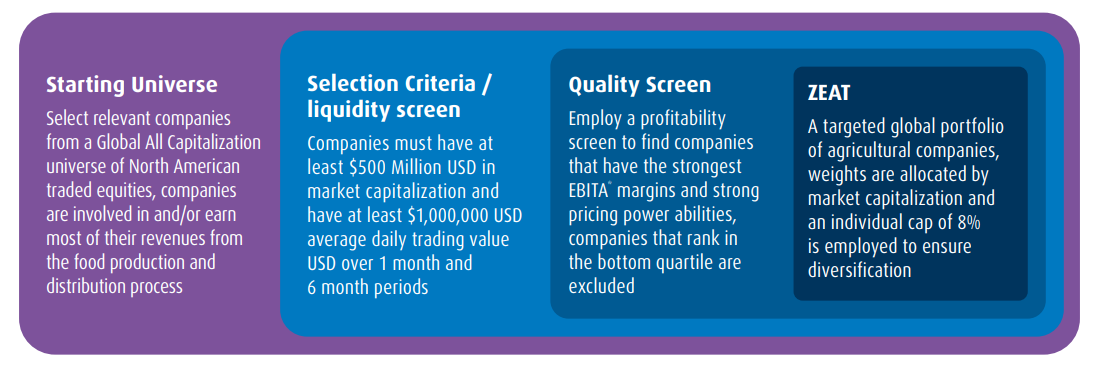

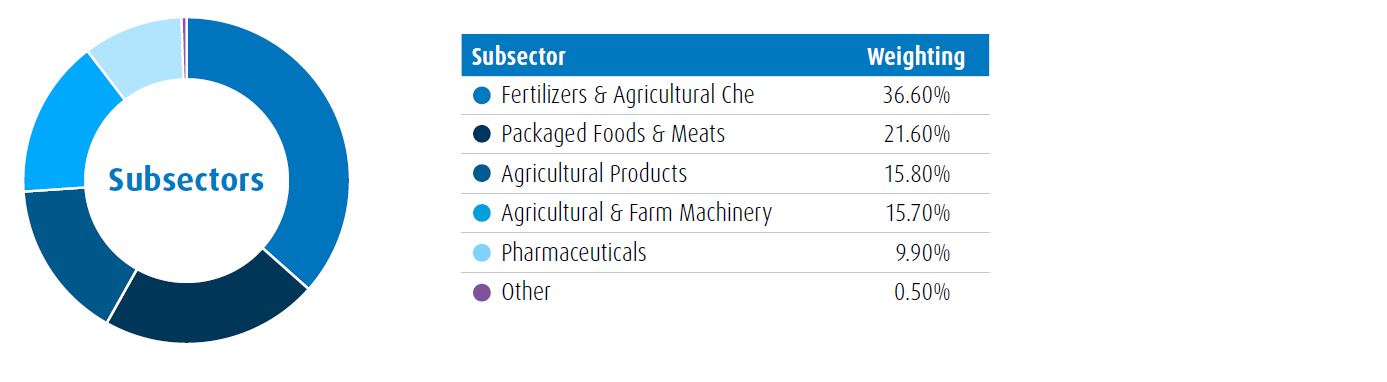

ZEAT will invest in global agriculture and agriculture related equities. Companies that are involved with the production of fertilizers and chemicals, manufacturers of farming machinery and food production/packaging companies will be included.

Key Facts:

| Ticker: | ZEAT |

| Management fee: | 0.35% |

| Risk rating: | Medium |

| Distribution Frequency: | Quarterly |

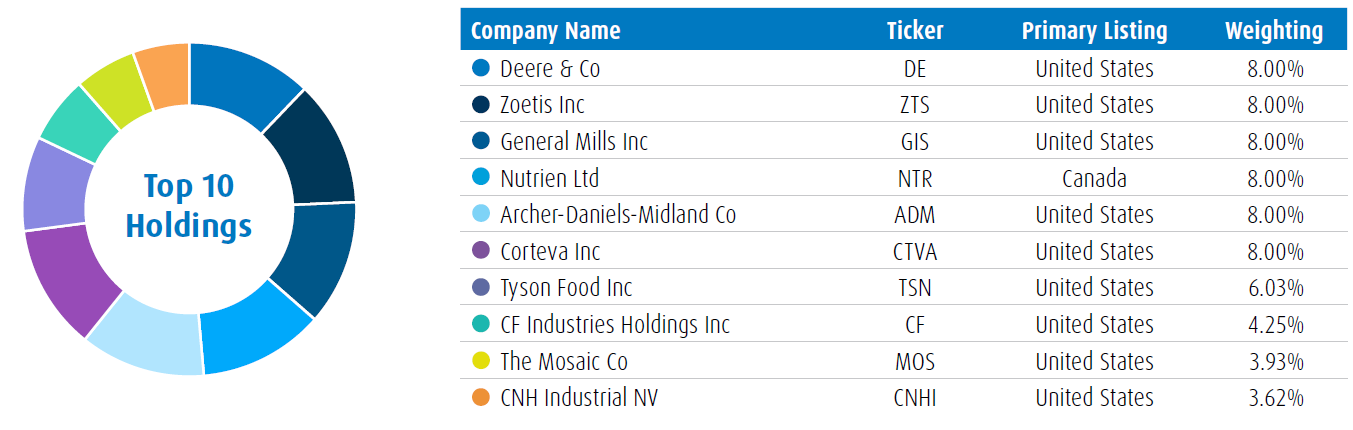

| Weighting: | Market Capitalization weighted, 8% individual max allocation |

Stock Selection Process

Portfolio Holdings†

Subsector Allocations†

* EBITA stands for Earnings before interest, taxes and amortization, it is used as reliable indicator of company provability. EBITA margins ultimately show how much operating expenses are eating into a company’s gross profit.

† The Target allocation of the Fund’s Top 10 Holdings and the Target Subsectors Breakdown is for illustrative purposes only and will change due to the Fund’s ongoing portfolio transactions without notice.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the fund facts or prospectus before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.