BMO Quality ETFs

Making Sense of Quality Investing

Oct. 25, 2024- BMO MSCI All Country World High Quality Index ETF (ZGQ)

- BMO MSCI USA High Quality Index ETF (ZUQ)

- BMO MSCI Europe High Quality Hedged to CAD Index ETF (ZEQ)

- BMO MSCI USA High Quality Index ETF Hedged units (ZUQ.F)

- BMO MSCI USA High Quality Index ETF US Dollar Units (ZUQ.U)

- BMO MSCI EAFE High Quality Index ETF (ZIQ)

Why the Quality Factor Matters

One of the most intuitive smart beta factors is quality investing. Quality based investing is built to identify market leading companies with sustainable competitive advantages. Research has shown that equity investing with a high quality focus has earned a premium while reducing risk over longer periods of time relative to the market.1 Part of the value is in the meaningful difference from traditional market capitalization indices where quality provides effective exposure throughout the entire market cycle. Furthermore, quality screening avoids inexpensive stocks masquerading as bargains.

What is Quality?

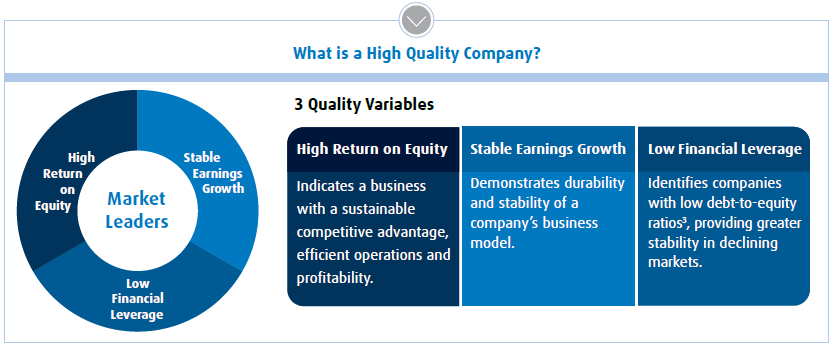

BMO Quality ETFs invest in high quality companies that provide greater long-term growth potential. High quality companies are defined as market leaders that have durable business models and sustainable competitive advantages. Quality growth companies typically have high return on equity (ROE)2, stable earnings and strong balance sheets with low financial leverage. These quality leaders are positioned to respond to positive market conditions, as well as potentially provide support in market contractions.

Each variable on its own is not necessarily an indicator of a quality company. For example, high ROE could be an abnormal spike at one point in time or a result of high leverage. The 3 variables in combination provide a more accurate assessment. BMO Quality ETFs consider these 3 quality variables in combination.

BMO Quality ETFs

BMO ETFs has created a suite of quality ETFs that captures high quality companies with a transparent, rules based portfolio methodology that aims to provide higher risk adjusted returns5 to investors. The BMO Quality ETF suite screens for companies with high quality scores based on 3 fundamental variables; high ROE, stable earnings growth and low financial leverage. The portfolio is built on the quality scores and the process is repeated at reweight to ensure the portfolio remains constructed with market leaders. The methodology aims to not only capture the performance of high quality companies, but to ensure reasonably high trading liquidity and to moderate security turnover while staying cost effective. BMO Quality ETFs are designed to be core equity options.

Methodology

BMO Quality ETFs track the performance of MSCI quality indices which are a subset of the broad market parent indices. Security selection relies on the determination of the 3 quality variables. Weighting is based on a combination of the security’s quality scores and market capitalization. Quality indices are rebalanced semi-annually.

QUALITY |

||||

BMO MSCI USA High Quality Index Distribution Frequency: Quarterly Management. Fee: 0.30% Risk Rating6: |

BMO MSCI All Country World ZGQ |

BMO MSCI Europe High Quality Hedged to CAD Index Distribution Frequency: Quarterly Management Fee: 0.40% Risk Rating6: Medium |

New |

BMO MSCI EAFE High Distribution Frequency: Quarterly Mgmt. Fee: 0.35% Risk Rating6: Medium |

For more detailed methodology information regarding the quality variables, security composite scoring, security selection, weighting and index maintenance, visit the MSCI quality indices website:

1 MSCI Research Report “Quality Time,” June 2023.

2 Return on Equity: A measure of a companies profitability & efficiency. Calculated by dividing net income/shareholders equity.

3 Debt to Equity Ratio: A measure o a company’s financial leverage. Calculated by dividing a company’s total liabilities/shareholder equity.

4 MSCI Quality Methodology: Section 3.1.1 Buffer Rules.

5 Return (risk-adjusted): A measure of investment performance taking into consideration how much risk/volatility was assumed to generate it. Consider two investments, both of which return 10% over a given time period. The investment with the greater risk-adjusted return would be the one that experienced less price fluctuation. Two of the most commonly used measures of risk adjusted returns are Sharpe and Sortino ratios.

6 All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ prospectus.

Changes in rates of exchange may also reduce the value of your investment.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

The BMO ETFs or securities referred to herein are not sponsored, endorsed or promoted by MSCI Inc. (“MSCI”), and MSCI bears no liability with respect to any such BMO ETFs or securities or any index on which such BMO ETFs or securities are based. The prospectus of the BMO ETFs contains a more detailed description of the limited relationship MSCI has with BMO Asset Management Inc. and any related BMO ETFs.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.