Protect Gains, Stay Invested with BMO Buffer ETFs

Aug. 7, 2024We have seen a remarkable run from stocks such as Nvidia as the potential of artificial intelligence has helped lift the S&P 500 Index to all-time highs. This may cause some valuation concerns among investors. The benchmark U.S. index is currently trading at a price-to-earnings ratio (P/E) of about 25 times, which from a historical perspective can be considered rich relative to the average of about 20.

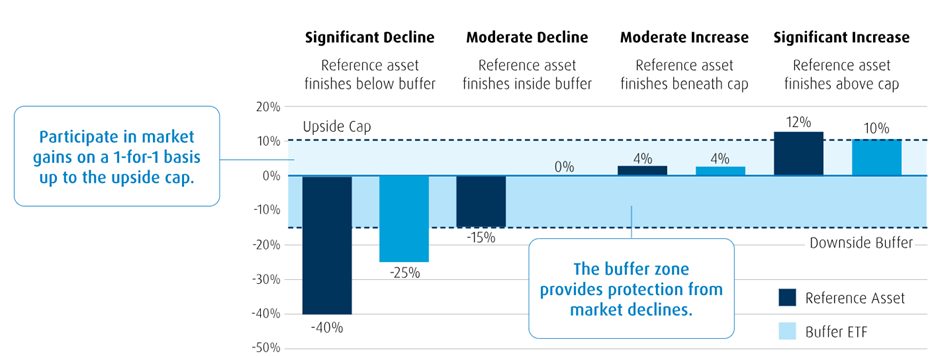

An allocation to BMO GAM’s buffer ETF can enable investors to participate in the market upside while putting a floor under their portfolio’s downside potential should stocks swoon from current levels.

Featured ETFs

Benefits

- Invests in U.S. Equities - earn price return of an underlying reference index up to a cap, plus dividends (before fees, expenses and taxes) while providing a buffer against the first 15% (before fees, expenses and taxes).

- Automatic Resets at the end of the outcome period with new parameters offering continuous protection.

- Professionally managed by BMO Global Asset Management.

Read More:

- Investment Executive: What are Buffer ETFs?

- BMO ETF Launch Summary – Expanding Our Suite of Structured Outcome ETFs

As discussed, one risk is high valuations, with P/E ratios on the main U.S. benchmark index elevated compared to historical levels (see chart).

S&P 500 Valuation – Historical P/E

In addition, the U.S. presidential election is quickly approaching in November, with expectations growing for volatility to increase, as has been witnessed in previous U.S. election cycles.

BMO ETFs’ new BMO US Equity Buffer Hedged to CAD ETF – July (Ticker: ZJUL) aims to protect returns while providing that downside cushion.

BMO ETFs has launched ZJUL for clients who may be looking to extend the protection of their portfolio in anticipation of a potential market pullback. Similar to our previous series, the new ZJUL expands the lineup of BMO’s current suite of Buffer ETFs, and seeks to provide investors with peace of mind by cushioning against the first 15% of losses on their portfolios over one year.1

ZJUL increases the duration of portfolio hedging, while still providing the potential for upside market participation. The upside is capped, while a client’s portfolio will incur no losses if the market declines 15% from its strike level.1 See the chart below for a visual representation of how the Fund provides downside protection, and upside participation.

Similarly, investors can re-optimize their hedges by rolling any existing and performing buffer ETF into the new maturity offered by ZJUL. The roll over will allow for the monetization of any current hedges and implement a new hedge at current market levels.

Finally, since ZJUL owns the S&P 500 as the underlying position,2 investors who invest in the Fund will collect index dividends on top of participating in the market’s upside (up to the cap).

A BMO GAM Buffer ETF can complement or substitute your core equity positions, providing a built-in cushion on the downside to help keep you invested in broad U.S. equities. Since 2010, in spans where the market has suffered a decline over a one-year period, 90% of the time it has been down less than 15%,3 underscoring the historical probability of being within the buffer zone.

For bullish investors who want to stay invested but are concerned about rich valuations among other risks, this buffer structure will be an important tool going forward to provide portfolio protection while allowing them to still participate, up to a cap, in a rising market.

1 If held from inception and purchased at starting NAV to the end of the Target Outcome Period, which is approximately the first week of July 2024 to last week of June 2025.

2 The underlying or reference asset is the BMO S&P 500 Hedged to CAD Index ETF.

3 BMO Global Asset Management/Bloomberg.

Advisor Use Only.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

An investor that purchases Units of a Structured Outcome ETF other than at starting NAV on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.