Gold: Three Reasons for Optimism, and One Risk to Watch

Mar. 7, 2025Since the beginning of 2024, the spot price for Gold has risen by near 40%.1 That is quite the feat considering that most central banks had stopped hiking rates last year, and the availability of higher yielding instruments should have meant that a ‘zero yielding asset’ such as a precious metal should have consolidated at the very least.

Nevertheless, we’re not here to diagnose what led to these remarkable gains. Instead, our focus for this note — which also dovetails nicely with the one-year anniversary of the launch of the BMO Gold Bullion ETF (Ticker: ZGLD)—is to examine whether or not we should expect to see further upside from here. And after careful thought and deliberation, we identify three reasons for optimism as well as one important risk to monitor.

The Futures Curve Points to Optimism

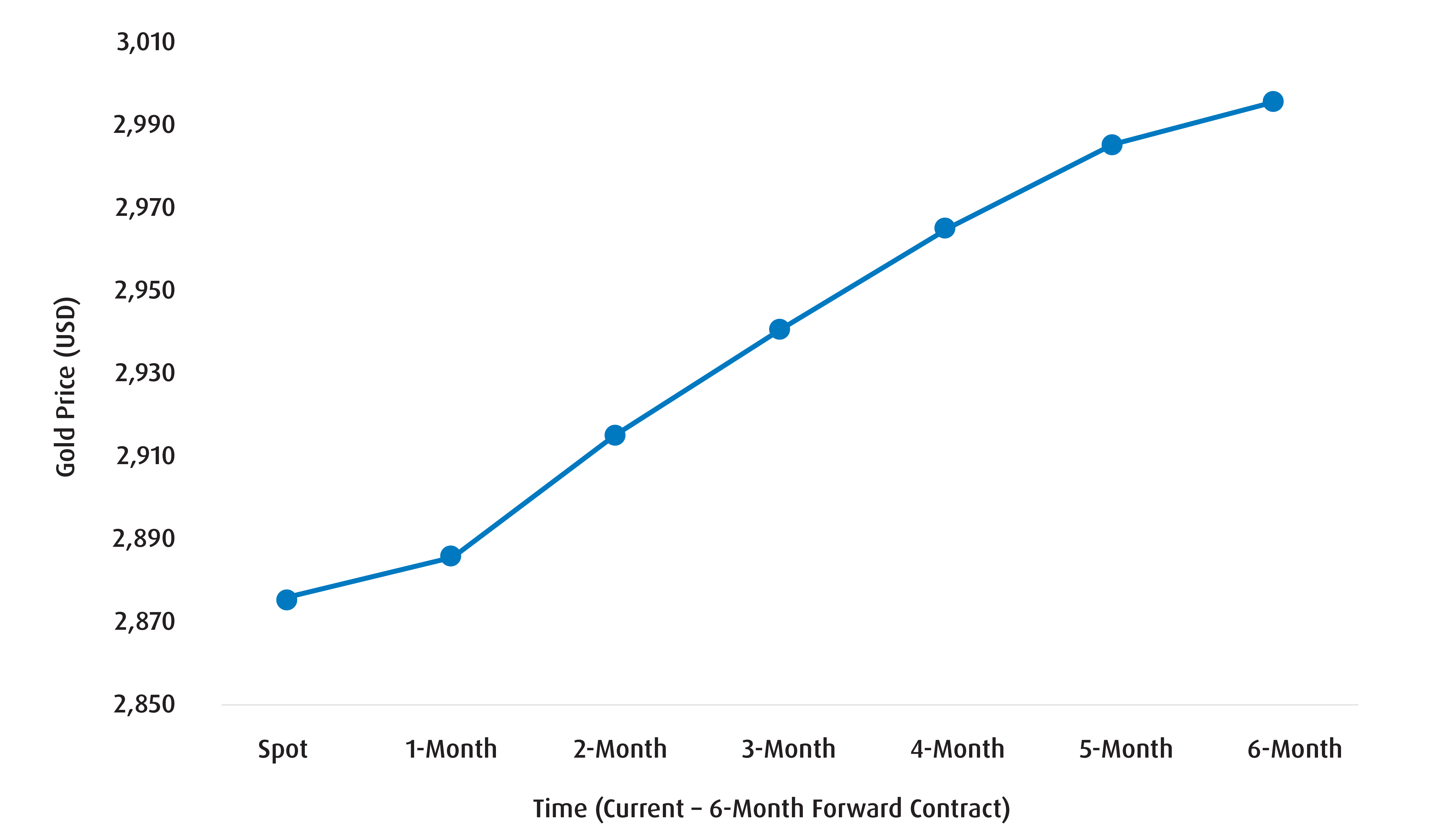

Dusting off of our Markets 101 textbook, we know that whenever the futures price of a commodity is trading higher than spot, the curve is said to be in ‘contango’. What that means is that investors are willing to pay a higher price in the future for a commodity and is characterized by an upward sloping forward curve (Chart 1). This will generally indicate that the market outlook is constructive for the underlying commodity.

Chart 1: The Futures Curve for Gold

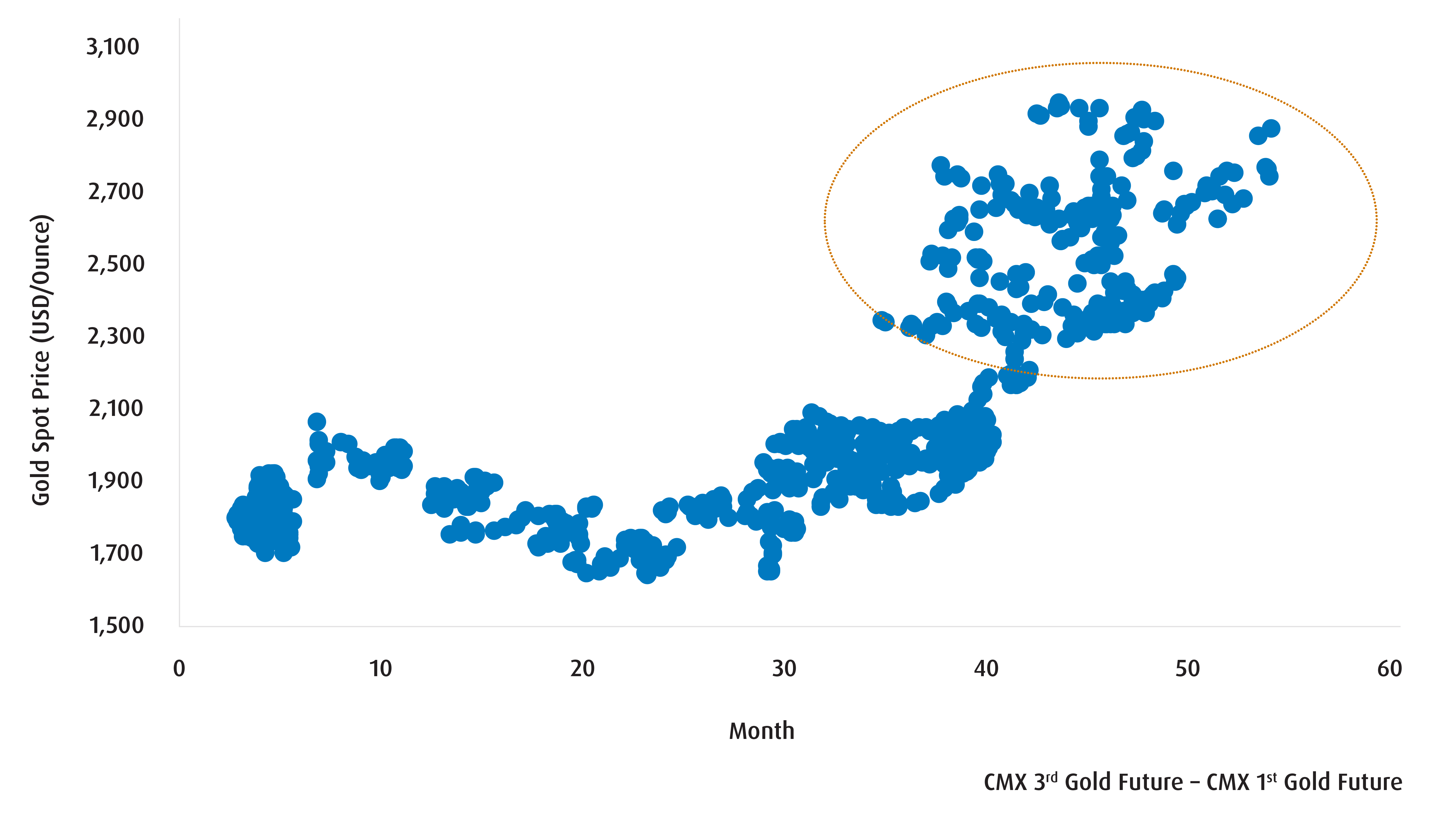

Over the past few years, the Gold futures curve has shifted deeper into contango. One way to get a sense of this is to track the spread2 of the 3-month contract vs. the prompt contract3 (Chart 2). As the delivery date nears, there is a ‘gravitational pull’ on spot prices to converge with where the futures contract is trading. Therefore, a curve that is deeper into contango tells us that the market (as of today) expects prices to be even higher in the future.

What has caused the shift in the degree of the contango? There could be several factors, or a combination of them, including rising storage/insurance costs (the cost of carry), supply/demand shifts or general uncertainty. The latter two variables are usually the more important factors to pay attention to from a fundamental perspective. Nevertheless, it does tell us that despite the recent consolidation, the market is still quite constructive on Gold going forward.

Chart 2: Deeper Nature of Contango Has Been Consistent with Higher Gold Spot Price

Supply Might Be Becoming a Concern

We do get the sense that the market is becoming somewhat sensitive to the supply/demand dynamics that are currently playing out.

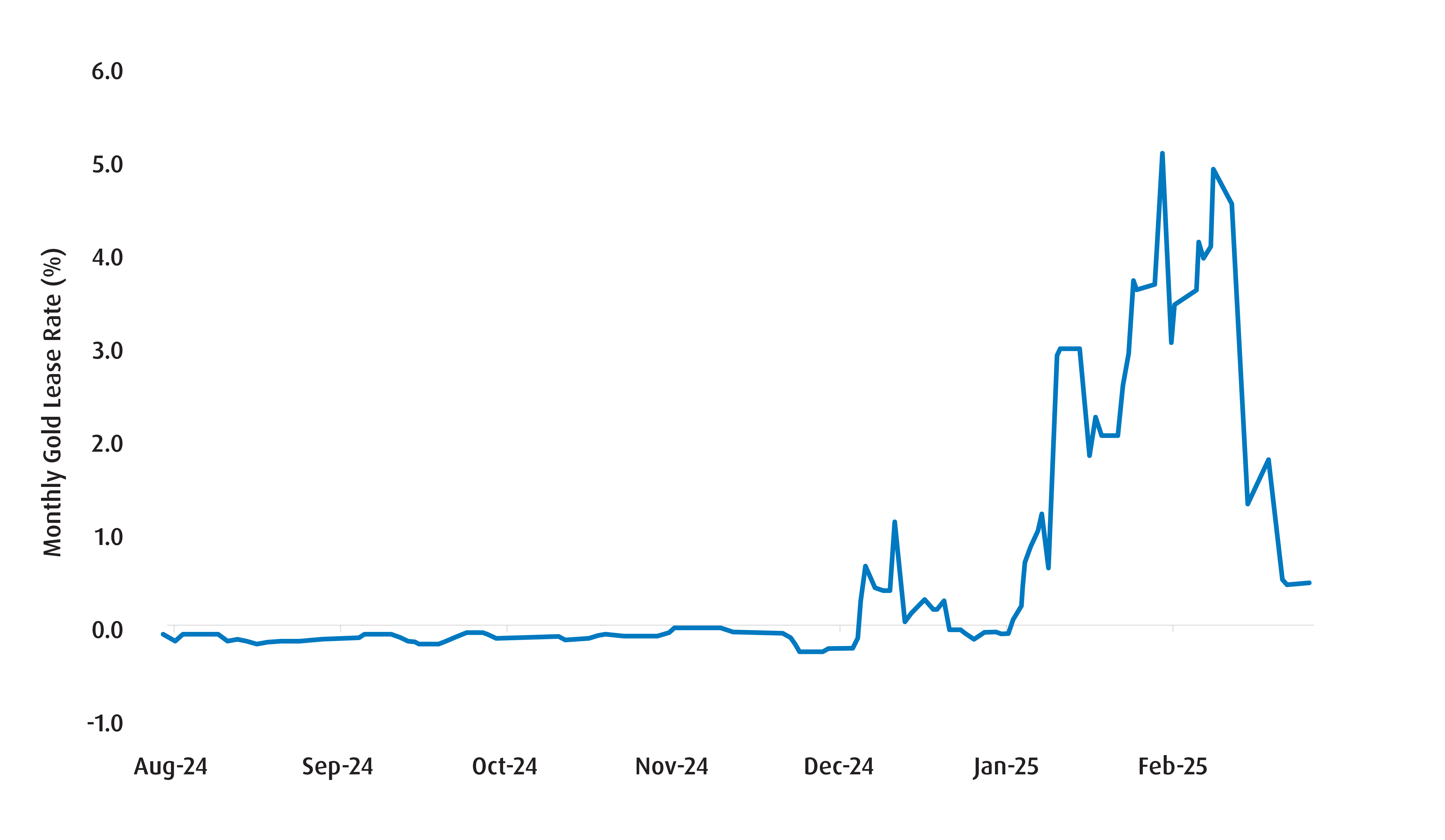

One way to gauge this is to consider the 1-month gold leasing rate – or the cost to borrow gold over a month. This rate spiked to 5% in late-January and early February (Chart 3) which is a signal that the supply of Gold on hand was becoming a pressing issue during that period.

The timing of this spike tells us that this likely had something to do with Trump’s trade policy and the uncertainty it is creating. Anecdotally around that time, we did hear of physical bullion being moved from London (where most of the volume of Gold is traded) to New York in response to the widening basis between those markets.

True, the lease rate has eased over the past few weeks, but increased uncertainty and the knock-on effects (supply shifts) they represent haven’t fully gone away.

Chart 3: The 1-Month Gold Lease Rate Has Been Volatile

Foreign Central Banks Continue to Diversify into Gold

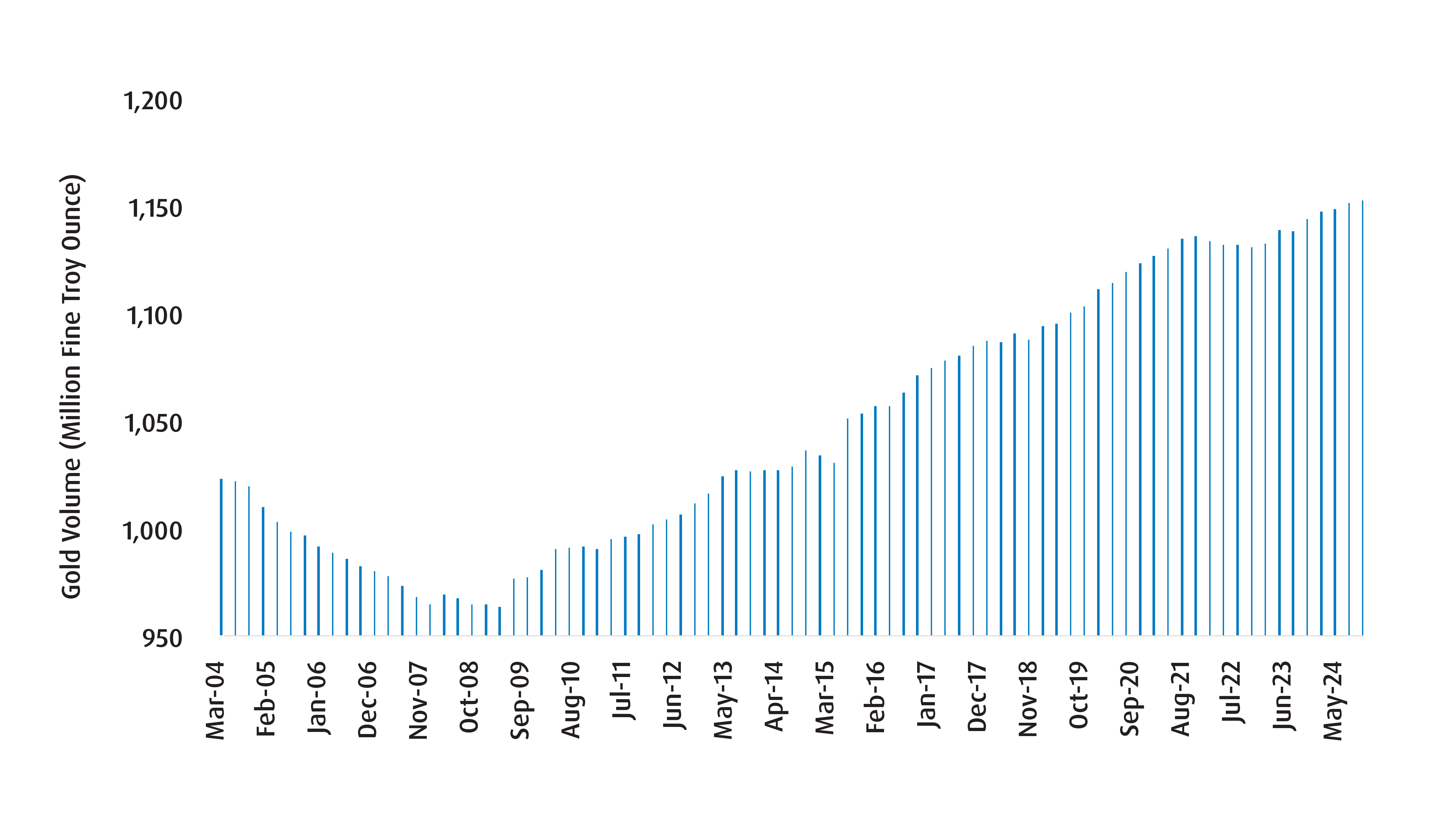

Yet another reason for supply concern is the fact that foreign central banks have been diversifying into Gold for years now.

Indeed, we sense that central bank reserve diversification away from the U.S. dollar (USD) and into Gold will remain an important theme. That’s not least because there are palpable concerns with the nature of persistent U.S. fiscal deficits, as well as countries with massive surpluses of savings becoming more cautious in light of unpredictable U.S. foreign policy. What’s more, there is also evidence that emerging market central banks have reassessed the risks of holding their Gold in vaults located in New York and London over the past few years, leading to a repatriation of physical gold and shifted supply/demand dynamics by a meaningful degree.

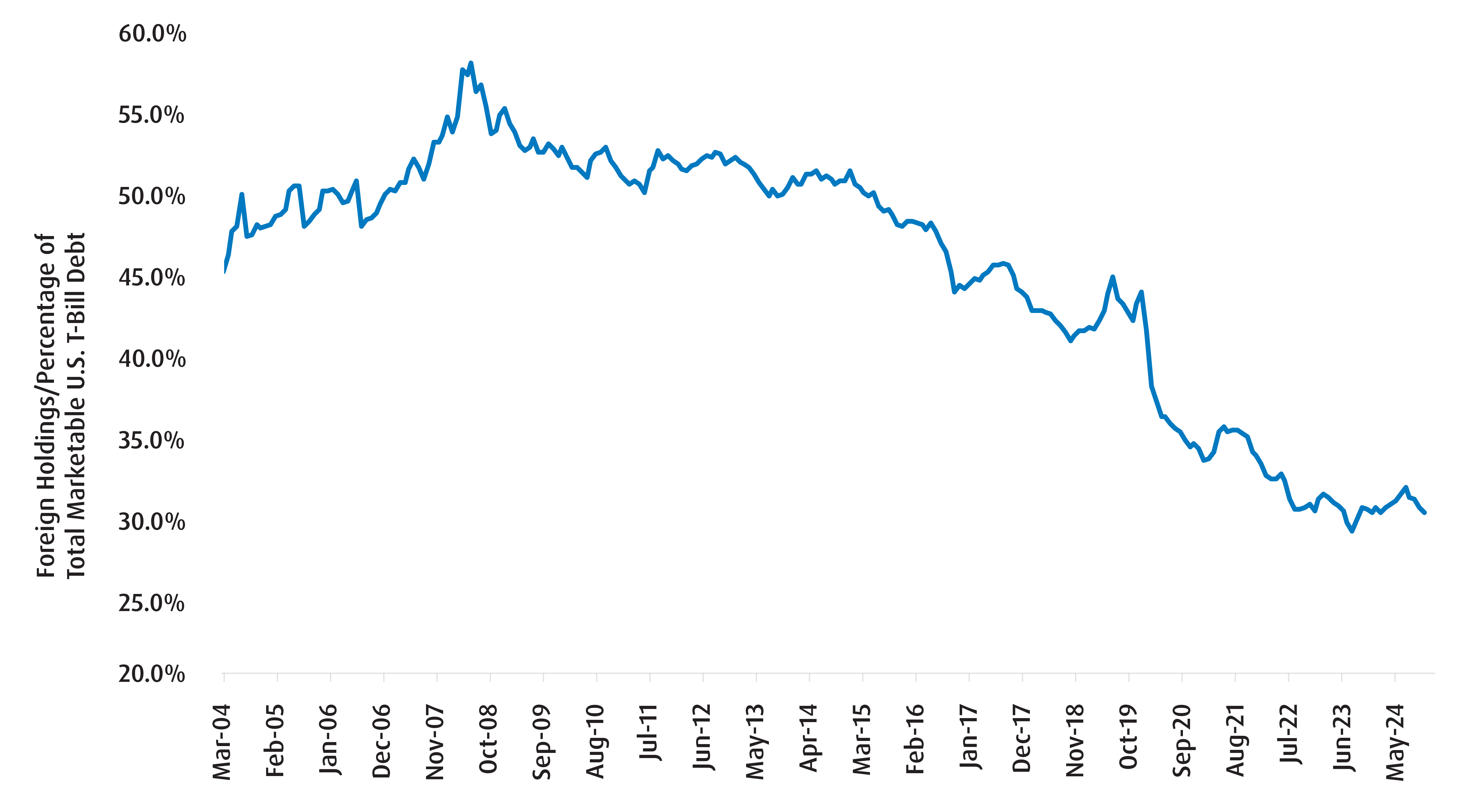

A cursory look at central bank holdings of Gold reveals that this rotation has been underway for some time now (Chart 4). Correspondingly, we’ve also seen a notable decline in the amount of U.S. Treasuries held by foreign central banks as a percentage of total U.S. marketable debt, as well (Chart 5). As U.S. foreign policy continues to shift towards becoming more insular, we don’t see an end to the above theme in sight.

Chart 4: World Central Bank Holdings of Gold Over Time

Chart 5: Foreign Holdings as a Percentage of Total Marketable U.S. Treasury Debt Continues to Trend Lower

But…Trump’s Crypto Policy Is an Important Risk

Rightly or wrongly, most analysts tend to lump Gold in the same pile as cryptocurrencies. That might be intellectually suspect given that the former is far less volatile and has a far longer track record. Nevertheless, there are some similarities between the two that leaves the precious metal at risk of ‘rotational’ outflows into crypto – for instance, both offer zero yields and are generally outside of the purview of sovereigns.

With the above in mind, Trump’s plans to create a ‘strategic crypto reserve’ does represent a near-term risk to spot Gold prices. Indeed, we have seen instances in the past whereby flows into, and out of crypto currencies has led to some degree of volatility in Gold. Trump’s plans imply investor enthusiasm for crypto should increase at the margin, and in turn, that implies a rotation in positioning within the ‘alternative sleeves’ of portfolios from Gold and into crypto. That is not least as Gold has done very well over the past few years and could be viewed as being overbought by some measures.

Over the Medium-to-Long-Term…

Having said all of the above, we still remain quite constructive on Gold over the long haul. While we acknowledge the near-term risks of a retracement, we feel the tailwinds from the geopolitical shifts, the supply/demand dynamics as well as market sentiment remain powerful drivers. As such, our bias is to wait for a deeper pullback in spot before adding to our position in ZGLD.

Performance (%):

Ticker |

Year-to-Date |

1-Month |

3-Month |

6-Month |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception |

Returns are not available as there is less than one year’s performance data. |

|||||||||

1 Gold Spot Rate (XAU), Bloomberg, as of February 28, 2025.

2 Spread: Refers to the difference between two related prices, rates, or yields, often used to describe the gap between the buying (bid) and selling (ask) price of an asset or the difference in yields between two similar financial instruments.

3 Prompt Contract: A contract, often within the context of futures or options trading, that has the shortest time to maturity, also known as the “near-month” or “front-month” contract.

Disclaimers:

The communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

March 5, 2025