Innovative Tax-Efficient Low-Cost Bond Solutions

BMO’s Suite of Discount Bond ETFs – ZDB, ZSDB & ZCDB

Dec. 19, 2024ZDB, ZSDB and ZCDB can help investors reduce taxable interest income relative to traditional bond funds with similar exposures.

BMO’s Discount Bond ETFs invest in bonds where the current yield is near or below par value. Having the coupon and Yield to Maturity (YTM) aligned provides investors with fair taxation.

| BMO Discount Bond Index ETF: ZDB Management fee: 0.09% Duration: 7.34 | BMO Short-Term Discount Bond ETF: ZSDB Management fee: 0.09% Duration: 2.45 | BMO Corporate Discount Bond ETF: ZCDB Management fee: 0.15% Duration: 3.40 |

Source: BMO Global Asset Management, as of December 10, 2024.

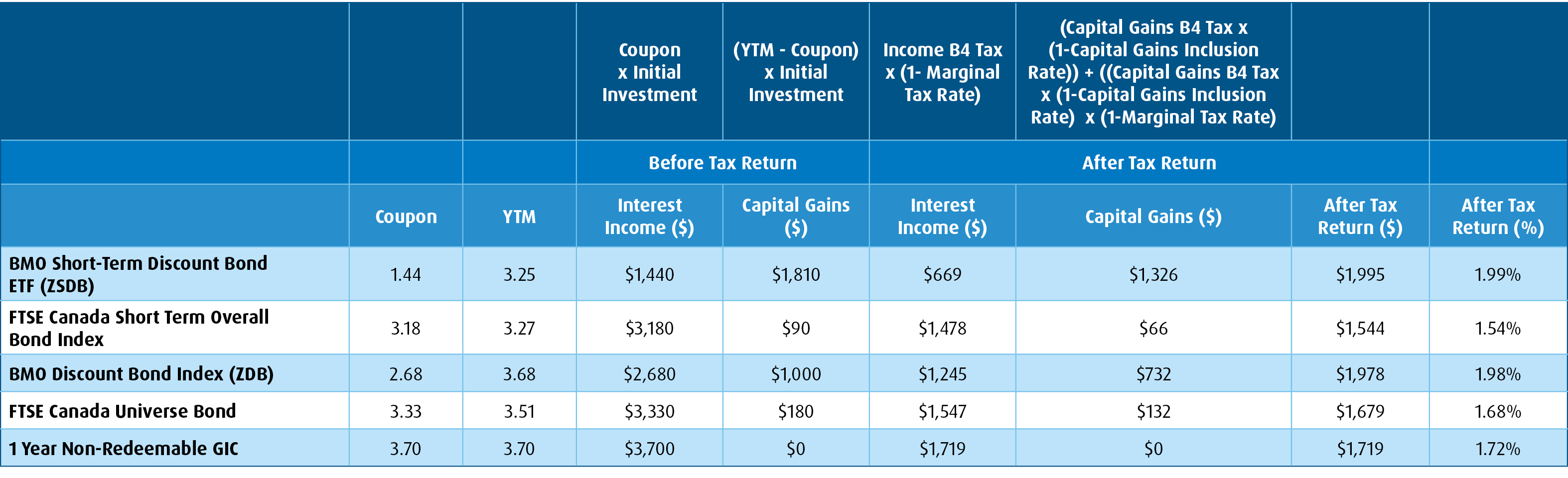

When the coupon is lower than the Yield to Maturity (YTM), that means that the bond is trading at a price that is below par. The advantage of buying an ETF that has a basket of bonds trading at a discount is that a portion of the future return will come from price appreciation (difference between the discounted price and the maturity value of $100) which is treated as a capital gain for tax purposes. Using a capital gain’s inclusion rate of 50%, means that half the capital gain is tax-free, while the other 50% is added to taxable income, with the coupon (interest) income. Therefore, all things being equal, investing in bonds with lower coupons can lead to better after tax returns. See illustration as example.

Initial investment of $100,000 – holding period 1 year (assumes that the investor holds for 1 year). BMO Guaranteed Investment Certificate 1-year non-redeemable rate as of September 9, 2024, compounded annually. YTM is calculated gross of fees.

10 Capital gains scenario assumes amount under $250,000, amounts over $250,000 after tax returns can vary.

11 Assuming the tax rate is 53.53%. Top marginal tax bracket will differ depending on province of residence.

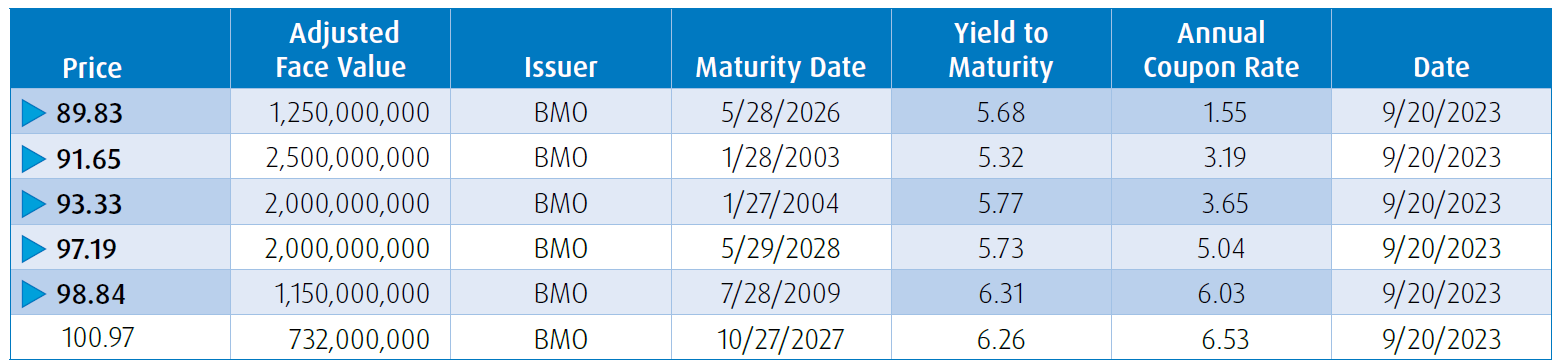

For taxable clients, tax is based on interest income (coupon earned) not yield, so it is advantageous to hold bonds that have a lower coupon. (example below).

* YTM is calculated gross of fees.

† Capital gains scenario assumes amount under $250,000, amounts over $250,000 after tax returns can vary.

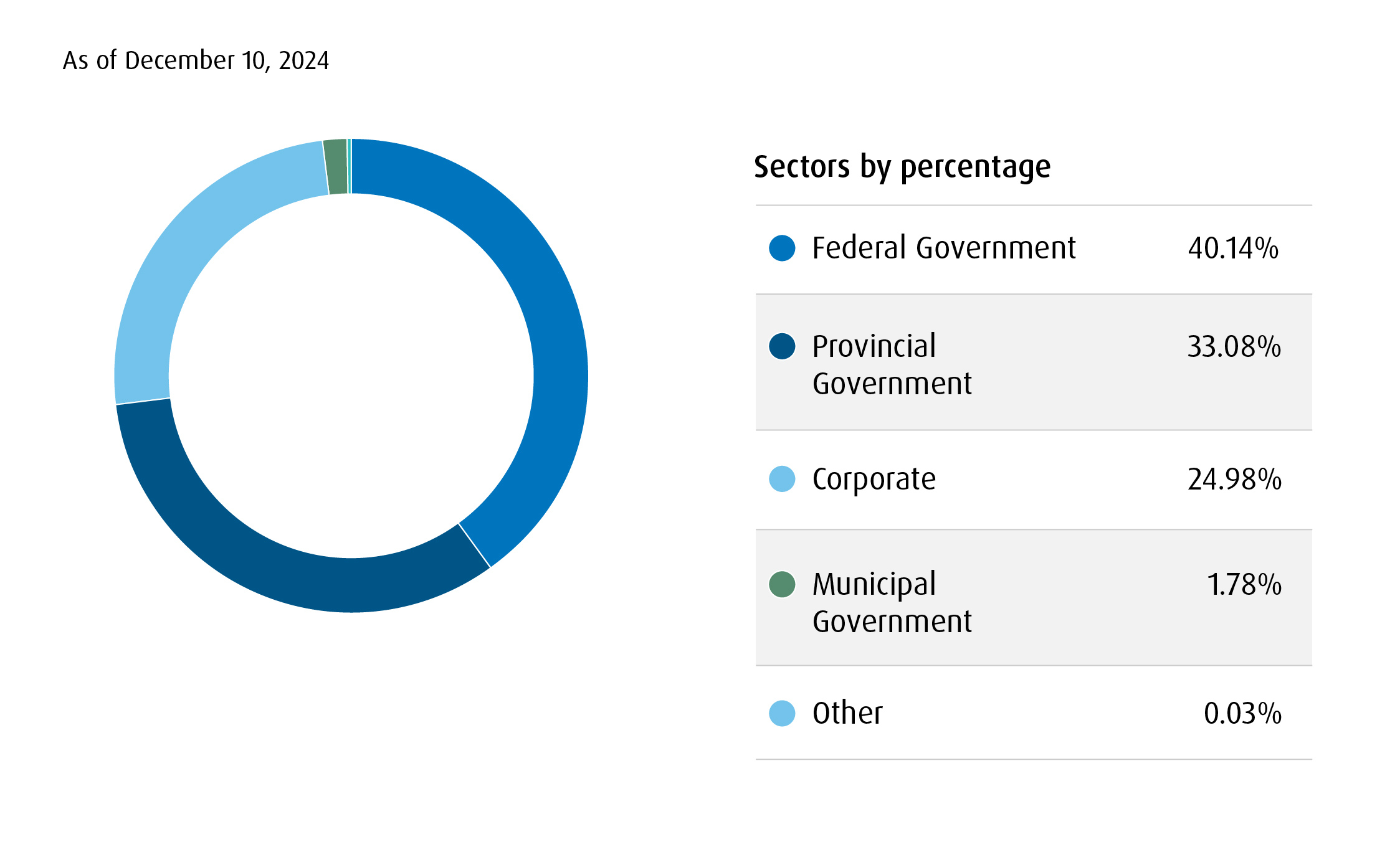

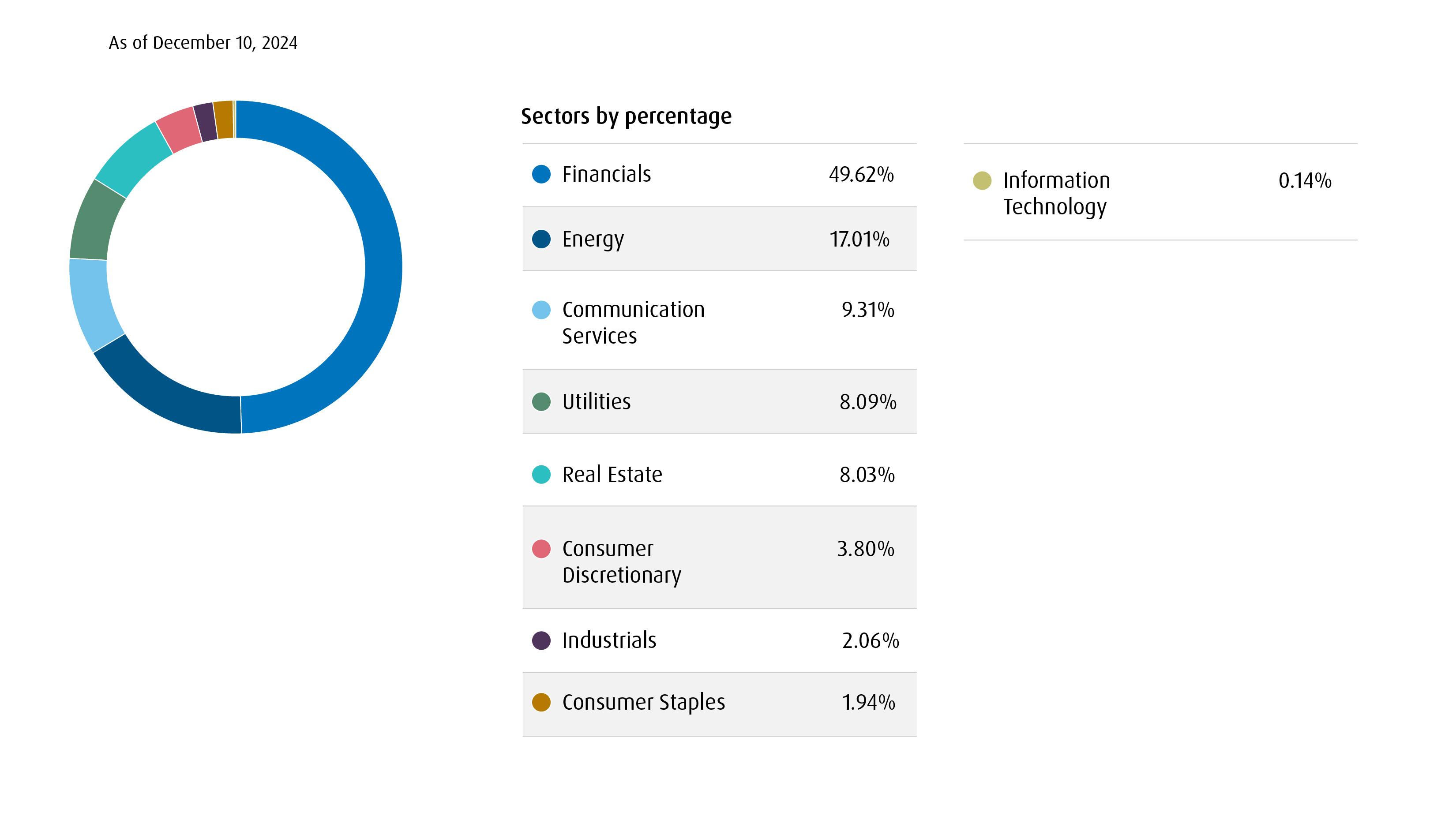

BMO Discount Bond Index ETF (Ticker: ZDB) has the yield-to-maturity, duration, and sector characteristics designed to approximate the Canadian Aggregate universe.

BMO Short-Term Discount Bond ETF (Ticker: ZSDB) has federal, provincial, corporate, and municipal bonds with a remaining term to maturity between one and five years that are issued in Canada and have an investment grade rating.

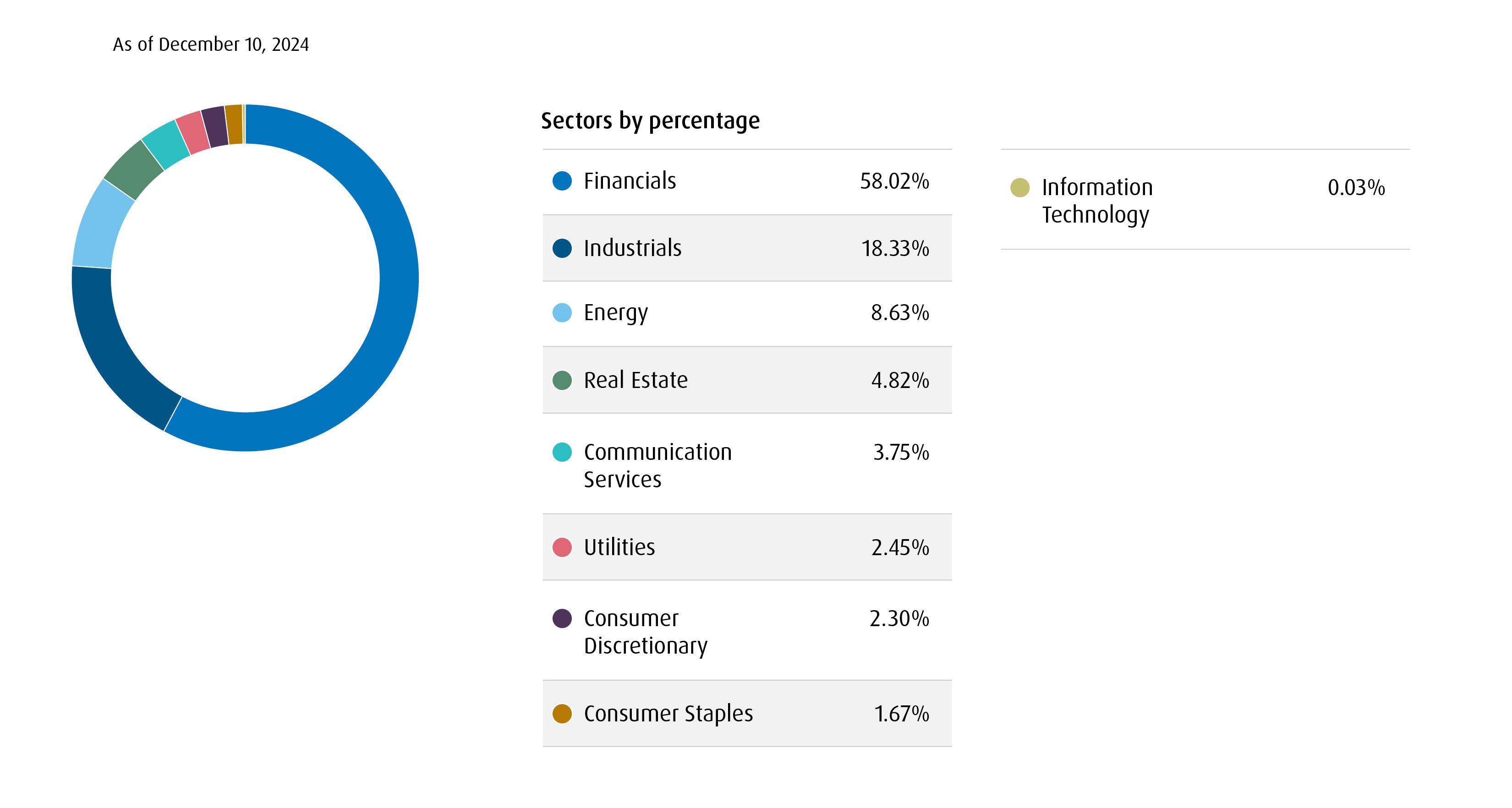

BMO Corporate Discount Bond ETF (Ticker: ZCDB) invests in corporate bonds with a remaining term to maturity between one to ten years that are issued in Canada and have an investment grade rating.

Performance Data

1-Year |

2-Year |

3-Year |

5-Year |

Since Inception |

|

9.29% |

6.74% |

— |

— |

2.85% |

|

7.08% |

5.38% |

— |

— |

2.46% |

|

8.43% |

4.82% |

-0.01% |

0.68% |

2.35% |

as of November 30, 2024

BMO Exchange Traded Funds (ETFs) have the experience & knowledge at understanding how ETFs can complement and enhance portfolio construction. BMO ETFs has the most comprehensive fixed income lineup in Canada with over 50 Fixed Income ETFs, and is the number 1 fixed income ETF provider in Canada based on AUM.*

* Source: NBF ETF Research, Bloomberg December 31, 2023.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). The yield calculation does not include reinvested distributions. Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and NAV fluctuations. The payment of distributions should not be confused with the BMO ETF’s performance, rate of return or yield. If distributions paid by a BMO ETF are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO ETF, and income and dividends earned by a BMO ETF, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Cash distributions, if any, on units of a BMO ETF (other than accumulating units or units subject to a distribution reinvestment plan) are expected to be paid primarily out of dividends or distributions, and other income or gains, received by the BMO ETF less the expenses of the BMO ETF, but may also consist of non-taxable amounts including returns of capital, which may be paid in the manager’s sole discretion. To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter, or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distributions, if any, in respect of the accumulating units of BMO Short Corporate Bond Index ETF, BMO Short Federal Bond Index ETF, BMO Short Provincial Bond Index ETF, BMO Ultra Short-Term Bond ETF and BMO Ultra Short-Term US Bond ETF will be automatically reinvested in additional accumulating units of the applicable BMO ETF. Following each distribution, the number of accumulating units of the applicable BMO ETF will be immediately consolidated so that the number of outstanding accumulating units of the applicable BMO ETF will be the same as the number of outstanding accumulating units before the distribution. Non-resident unitholders may have the number of securities reduced due to withholding tax. Certain BMO ETFs have adopted a distribution reinvestment plan, which provides that a unitholder may elect to automatically reinvest all cash distributions paid on units held by that unitholder in additional units of the applicable BMO ETF in accordance with the terms of the distribution reinvestment plan. For further information, see the distribution policy in the BMO ETFs’ prospectus.

Portfolio holdings are subject to change without notice and may not represent current or future portfolio composition. The portfolio data is “as of” the date indicated, and we disclaim any responsibility to update the information. MERs are as of Sept 30, 2020. This communication should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaran- teed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under license.

Publication Date: December 19, 2024.