Investing With BMO’s Asset Allocation ETFs

Asset Allocation ETFs: An important decision, simplified

Feb. 8, 2023- BMO Conservative ETF (ZCON)

- BMO Balanced ETF (ZBAL)

- BMO Balanced ETF (ZBAL.T)

- BMO Growth ETF (ZGRO)

- BMO Growth ETF (ZGRO.T) | NEW!

- BMO All-Equity ETF (ZEQT)

- BMO Monthly Income ETF (ZMI)

- BMO Monthly Income ETF (ZMI.U)

- BMO Balanced ESG ETF (ZESG)

“Asset allocation explains over 90 per cent of the variation in a portfolio’s quarterly returns”

1986 study by Brinson, Hood, and Beebower, “Determinants of Portfolio Performance”

8 Reasons to Buy Asset Allocation ETFS

- Simplified Investing – All-in-one Investment Solution that provides instant diversification

- Broad diversification – Consisting of a basket of ETF that in themselves hold many securities

- Professionally constructed – Leverage the Asset Allocation experience of industry professionals

- Automatic Rebalancing – Keeps one’s investment portfolio on track to risk and return objectives

- Transparency – Knowing what is in the ETF can help reduce duplication when complementing a portfolio

- Liquid – Able to buy or sell the basket of holdings at any time

- Lower cost – ETF based solutions tend to charge lower fees than other diversified investments

- All-in-one cost structure – Most popular Asset Allocation ETFs only charge the one top fee without charging the underlying ETF costs

Why Does the Mix Matter?

A portfolio’s asset allocation may have a large impact on an investor’s long-term returns.

The decision between a conservative, balanced, growth and all-equity portfolio reflects an investor’s risk/return profile. An investor must define their return objectives and determine their ability and willingness to accept market risk. An investor must consider factors such as time horizon and investment goals. A longer investing time horizon allows for more allocation to riskier assets such as equities, this is because an investor has more time to recover from short-term corrections. Each investing goal has its own unique asset allocation. Saving for a house, retirement or for education would each have its own optimal asset mix.

BMO’s Asset Allocation ETFs: Methodology and Construction

BMO offers eight asset allocation ETFs where investors can access their optimal asset allocation:

- BMO Conservative ETF (ZCON)

- BMO Balanced ETF (ZBAL)

- BMO Balanced ETF (ZBAL.T) | 6% distribution*

- BMO Growth ETF (ZGRO)

- BMO Growth ETF (ZGRO.T) | NEW! | 6% annual distribution paid monthly*

- BMO All-Equity ETF (ZEQT)

- BMO Monthly Income ETF (ZMI)

- BMO Monthly Income ETF (ZMI.U) | U.S currency

- BMO Balanced ESG ETF (ZESG)

Market movements impact the asset allocation and cause it to shift over time. BMO’s Asset Allocation ETFs will follow a disciplined approach to asset allocation. The ETFs will rebalance quarterly back to their target asset allocation weights. Each ETF holds BMO index ETFs that provide exposure to Canadian, U.S. and International equities and bonds.

BMO’s Asset Allocation ETFs are an investing solution built to disciplined index weights which aim to provide investors with an ETF that is low-cost, easy to access and simple to use.

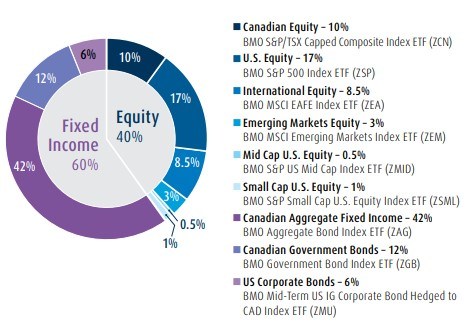

BMO Conservative ETF (Ticker: ZCON)

For investors looking for more security, income, and moderate long-term growth

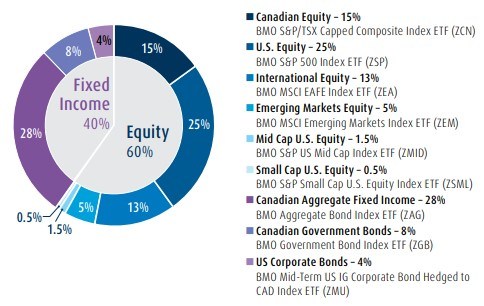

BMO Balanced ETF (Ticker: ZBAL/ZBAL.T)

For investors looking for moderate income and more potential for long-term growth. ZBAL.T is for investors looking for a consistent monthly cash flow of 6% (annualized and paid monthly).

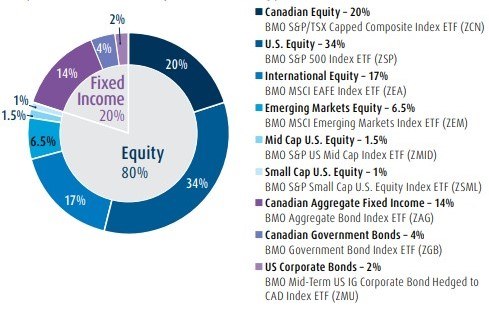

BMO Growth ETF (Ticker: ZGRO/ZGRO.T)

For investors looking for moderate income and more potential for long-term growth. ZFRO.T is for investors looking for a consistent monthly cash flow of 6%

(annualized and paid monthly).

BMO All-Equity ETF (Ticker: ZEQT)

For investors looking for the potential for long-term growth.

BMO Monthly Income ETF (Ticker: ZMI/ZMI.U)

For investors looking for higher yielding ETFs.

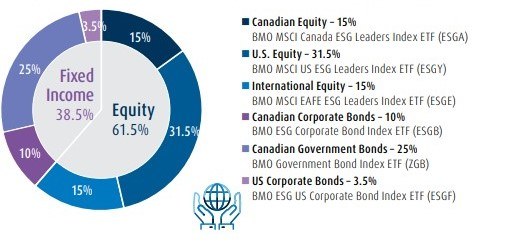

BMO Balanced ESG ETF (Ticker: ZESG)

For investors looking to align their investments with their social values. ZESG is a balanced asset allocation ETF which offers moderate income and more potential for long-term growth

Target Asset Allocation as of December 31st 2022. The portfolio holdings are subject to change without notice. They are not recommendations to buy or sell any particular security.

*These units are Fixed Percentage Distribution Units that provide a fixed monthly distribution based on an annual distribution rate of 6%. Distributions may be comprised of net income, net realized capital gains and/or a return of capital.

This whitepaper is for information purposes. The information contained herein is not, and should not be construed as, investment advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.