The Factor Effect: A Brief History of Capturing Alpha While Curbing Impulses

Mar. 24, 2025“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

- Benjamin Graham, The Intelligent Investor

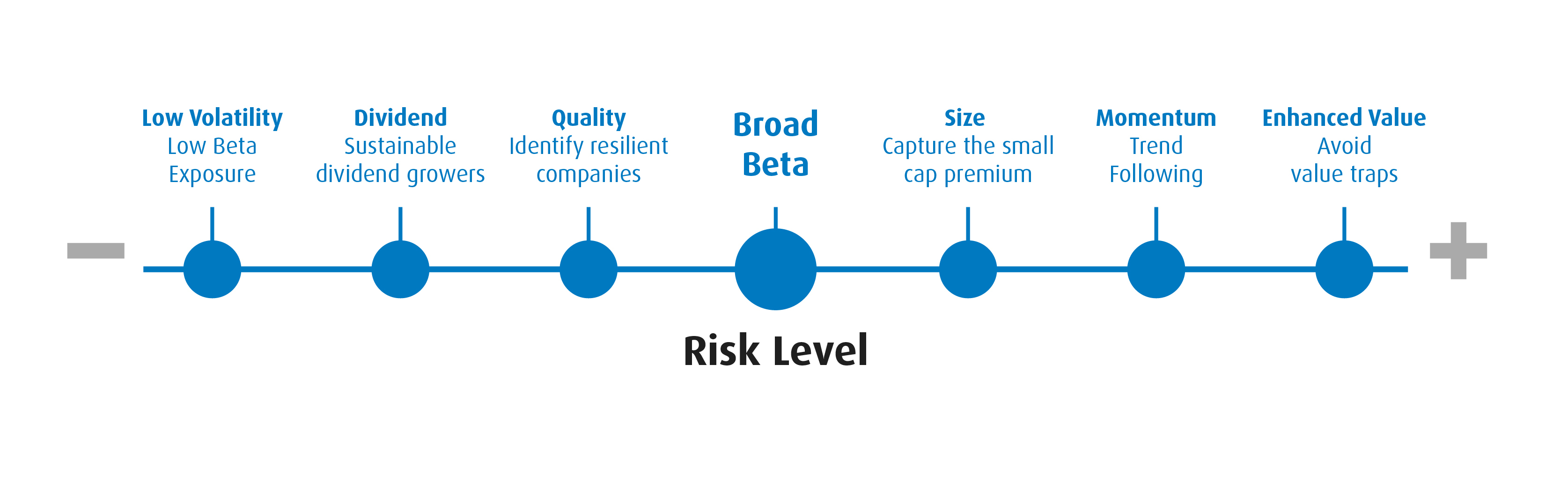

Factor investing is gaining wider appreciation. Academic papers have demonstrated that Factors are the leading determinant of the elusive concept we refer to as Alpha.1 Like active management Alpha, Factors are also cyclical, but unlike active management they maintain their objectivity throughout a market cycle, without some of the drift or subjectivities which may arise in active management. For investment counsellors looking for complementary strategies or to invest in International or Global equity markets, Factor equity ETFs may provide suitable exposures to help diversify portfolios and manage risk.

Investors are drawn to active management because it provides several appealing refinements to indexing investing; principally a concentrated, high-conviction portfolio with high active share and lots of tracking error, providing the ability to produce Alpha or outperformance.

Interestingly, in our view Factors offer the same attributes, albeit in a transparent, rules-based methodology which, in most cases, is more enduring than active manager cyclicality.

Alpha / Beta Definition and the Rise of Modern Investing

The S&P 500 index was conceived in 1956 and published the following year. It was intended to be a measuring tool to determine whether active managers were skillful or lucky. Though the Dow Jones Industrial Average had been a benchmark since the late nineteenth century, the price-weighted index had outlived its relevance. Heightened computing power was able to track more companies, providing a more representative market capitalization perspective.

The outcomes were surprising. Most active managers were unable to provide consistent outperformance over the benchmark, sparking interest in synthetic exposures including futures and swaps.

Around the same time and into later decades, academics proposed several concepts to explain investment performance, ranging from Harry Markowitz’s Modern Portfolio Theory (MPT) in 1952 to the Capital Asset Pricing Model, or CAPM (1964), to the Efficient Market Hypothesis (EMH) in 1970. These theories sought to explain capital market behaviour.

Notwithstanding the strong foundation these approaches provided, researchers continued to tabulate returns, parsing them through increasingly detailed attribution analyses, eventually identifying clearly defined investment Factors that explained returns. Using copious data, a view emerged that Factors explained the variability across different active managers, more so than security selection or market timing.

Factors differ markedly from investment styles, demonstrating significant enhancements over simple Growth and Value distinctions. Whereas Style indices retain a market capitalization weight, Factor indices weight constituents by their Factor matrices, producing a more concentrated, higher-conviction portfolio, similar to what might be expected in an active mandate.

Factor |

Style |

|

Precise, highly defined |

Focus / Definition |

General, loosely defined |

Concentration, conviction portfolio with higher active share |

Exposure |

Moderate refinement with lower active share |

Source: BMO Global Asset Management. For illustrative purposes only.

Identifying Factors was a significant leap ahead of the elementary distinction that Alpha/Beta had provided in the 1950s, but Factors also helped explain what psychologists called “behavioural finance” — or the emotional impulses that defied the data-driven, logical directives established in MPT, CAPM and EMH.

In investing, as in life, there is a constant struggle between logic and emotion, perhaps best summarized in a simple quote from Benjamin Graham’s book The Intelligent Investor: “The investor’s chief problem – and even his worst enemy – is likely to be himself.”

Such humble comments acknowledge that some elements in investing may not always be grounded in data-and process-driven. Even professional allocators should be aware some of their own decisions may be infused with preferences or biases.

Factors, due to clearly defined characteristics, provide objectivity and consistency in their data sets, establishing a strong engagement platform for investment counselling firms with their clients.

Factor |

Preference or Bias |

Characteristics |

Low Volatility |

Risk Minimization |

Low Beta with Sector Constraints |

Dividend |

Income Preference |

Sustainable Dividend Growers |

Quality |

Risk Minimization |

High RoE, Stable Earnings Growth, Low Leverage |

Size |

Illiquidity / Coverage Premium |

Small Minus Big |

Momentum |

Trend Following & Recency Bias |

Weighting to Companies |

Enhanced Value |

Disposition Bias / Sunk Cost Fallacy |

Low P/E, Low P/B, Low P/EV |

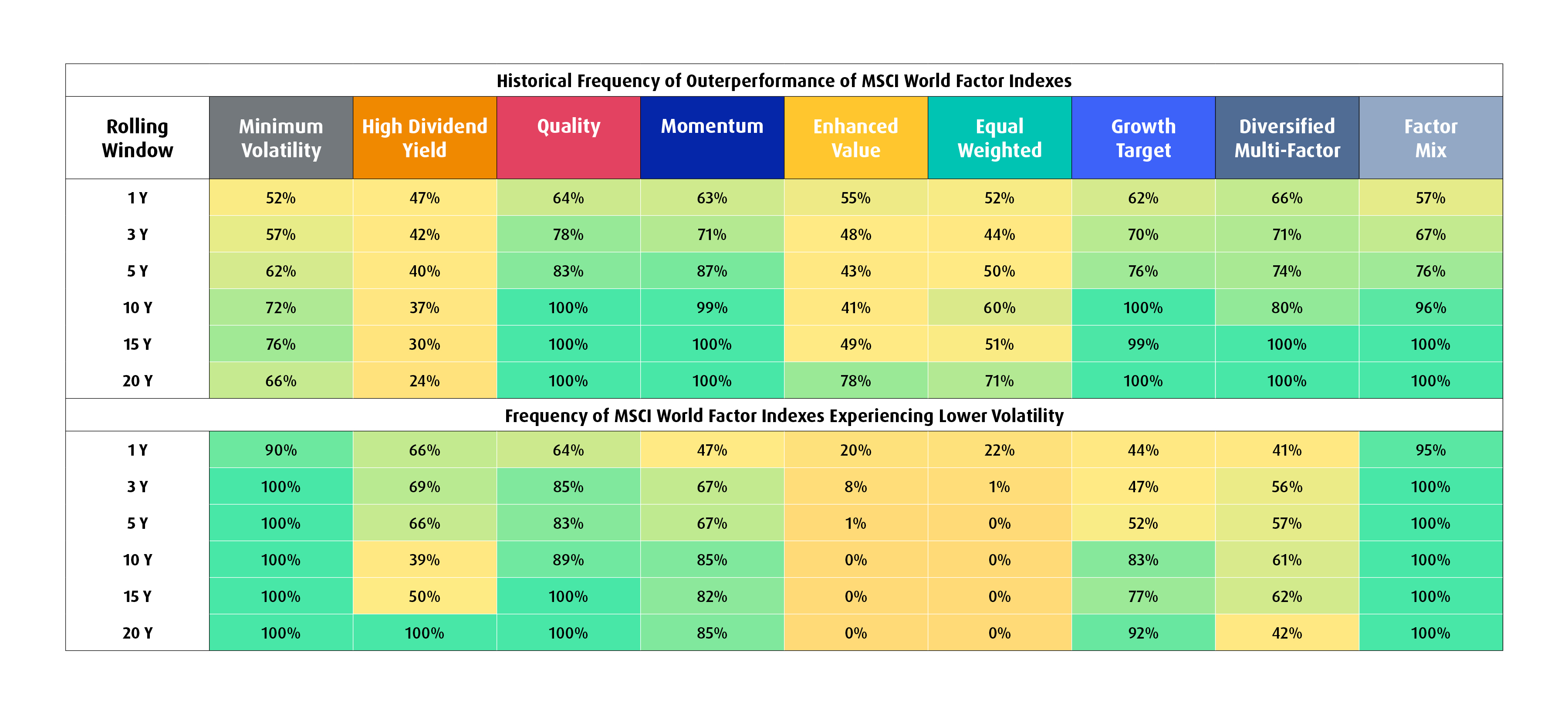

It is useful to appreciate how Factors capture innate financial behaviours but it is also important to appreciate the strong investment thesis they provide to asset allocation and portfolio construction. As the table below outlines, most Factors have historically displayed both enhanced performance and lower risk on a compounded basis. The sole exception is Value which, in part, can be explained by the stimulative or accommodative rates we have had for may years. When rates rose in 2022, Value showed its worth.

Table 1 – Diversification Effects Over Longer Time Periods

Longer time horizons > higher historical occurrence of outperformance, with diversification benefits becoming apparent over longer investment periods.

Understanding Factors, their essence, strong investment thesis and how they can be aligned provides multi-family offices and investment counsellors with a better ability to shape portfolios to meet client risk and return objectives.

As one of the strongest Factor ETF providers in Canada, BMO ETFs offers listings for Low Volatility, Dividend, Quality, Size and Enhanced Value across Canada, the United States, International and Global mandates.

Low Vol |

Quality |

Dividend |

Value |

|||||

BMO Low Volatility Canadian Equity |

BMO MSCI EAFE High Quality Index |

BMO Canadian Dividend |

BMO MSCI Canada Value Index |

|||||

BMO Low Volatility US Equity |

BMO MSCI USA High Quality Index |

BMO US Dividend |

BMO MSCI USA Value Index |

|||||

BMO Low Volatility International Equity |

BMO MSCI All Country World High Quality Index |

BMO International Dividend |

||||||

Mid & Small Cap |

||||||||

BMO Low Volatility Emerging Markets Equity |

BMO MSCI Europe High Quality Hedged to CAD Index |

BMO S&P US Mid Cap Index |

BMO S&P US Small Cap Index |

|||||

Please contact your BMO institutional sales partner for additional market insights.

Performance (%):

Year-to-Date |

1-Month |

3-Month |

6-Month |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception |

|

ZLB |

4.50 |

2.93 |

1.70 |

5.86 |

17.50 |

10.04 |

10.88 |

9.00 |

12.11 |

ZLH |

6.52 |

3.81 |

-0.12 |

2.78 |

15.92 |

6.31 |

9.11 |

- |

9.09 |

ZLU |

7.33 |

3.40 |

3.44 |

10.69 |

24.55 |

11.90 |

11.64 |

10.78 |

14.25 |

ZLU.U |

6.64 |

3.92 |

0.11 |

3.11 |

16.84 |

7.07 |

9.98 |

9.18 |

11.02 |

ZIQ |

Returns are not available as there is less than one year’s performance data |

||||||||

ZUQ.F |

2.77 |

-0.83 |

-.067 |

2.53 |

14.03 |

13.47 |

- |

- |

14.45 |

ZUQ |

3.66 |

-1.14 |

3.02 |

10.75 |

22.91 |

19.92 |

18.97 |

15.89 |

17.11 |

ZUQ.U |

2.99 |

-0.69 |

-0.30 |

3.17 |

15.30 |

14.75 |

- |

- |

15.59 |

ZDV |

3.88 |

0.87 |

0.23 |

8.21 |

19.91 |

7.35 |

11.02 |

7.29 |

7.88 |

ZVC |

1.48 |

-1.39 |

-1.41 |

5.95 |

13.04 |

8.14 |

13.43 |

- |

9.21 |

ZLD |

5.69 |

1.67 |

5.35 |

4.76 |

14.83 |

8.69 |

6.67 |

- |

6.85 |

ZLI |

7.28 |

2.01 |

6.85 |

6.48 |

18.02 |

8.30 |

5.50 |

- |

6.09 |

ZGQ |

2.96 |

-1.73 |

2.95 |

7.28 |

19.34 |

16.30 |

16.57 |

13.54 |

14.64 |

ZUD |

5.27 |

1.69 |

0.49 |

5.56 |

17.78 |

8.62 |

10.43 |

8.40 |

9.68 |

ZDY |

6.03 |

1.33 |

4.00 |

13.54 |

26.41 |

14.44 |

13.16 |

10.98 |

13.64 |

ZDY.U |

5.35 |

1.79 |

0.65 |

5.77 |

18.59 |

9.51 |

11.48 |

9.38 |

10.43 |

ZVU |

5.89 |

0.52 |

0.87 |

11.86 |

17.59 |

8.94 |

11.40 |

- |

9.18 |

ZLE |

0.92 |

-1.15 |

2.58 |

4.54 |

12.10 |

4.80 |

1.69 |

- |

1.92 |

ZEQ |

9.20 |

2.32 |

7.75 |

0.03 |

6.79 |

7.97 |

10.00 |

8.56 |

9.58 |

ZMID |

-0.10 |

-4.81 |

-4.78 |

8.00 |

15.37 |

11.23 |

14.24 |

- |

11.25 |

ZMID.F |

-1.00 |

-4.55 |

-8.30 |

-0.16 |

7.03 |

5.20 |

10.90 |

- |

7.80 |

ZMID.U |

-0.74 |

-4.37 |

-7.84 |

0.60 |

8.23 |

6.43 |

12.55 |

- |

9.40 |

ZSML |

-2.37 |

-6.16 |

-7.81 |

4.20 |

12.78 |

7.14 |

11.96 |

- |

8.93 |

ZSML.F |

-3.28 |

-5.93 |

-11.26 |

-3.73 |

4.64 |

1.27 |

8.60 |

- |

5.47 |

ZSML.U |

-2.99 |

-5.73 |

-10.78 |

-2.93 |

5.80 |

2.52 |

10.29 |

- |

7.12 |

Source: Bloomberg, as of February 28, 2025. Inception date for ZLB = October 21, 2011, ZLH = February 4, 2016, ZLU = March 19, 2013, ZLU.U = March 19, 2013, ZIQ = October 24, 2024, ZUQ.F = July 17, 2020, ZUQ = November 5, 2014, ZUQ.U = July 20, 2020, ZDV = October 21, 2011, ZVC = October 4, 2017, ZLD = February 4, 2016, ZLI = September 2, 2015, ZGQ = November 5, 2014, ZUD = March 19, 2013, ZDY = March 19, 2013, ZDY.U = March 19, 2013, ZVU = October 4, 2017, ZLE = May 10, 2016, ZEQ = February 10, 2014, ZMID = February 5, 2020, ZMID.F = February 5, 2020, ZMID.U = February 5, 2020, ZSML = February 5, 2020, ZSML.F = February 5, 2020, ZSML.U = February 5, 2020.

1 “Factor investing: alpha concentration versus diversification,” L. Heinrich, A. Shivarova, M. Zurek. Journal of Asset Management, 2021.

Disclaimers:

For Advisor and institutional use.

This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the Portfolio Manager’s represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

The Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.