To Hedge FX Risk, or Not to Hedge

Oct. 15, 2024Admittedly, using a spin on a famous Shakespeare quote to start a note on currency hedging is verging on trite. Nevertheless, if Hamlet was running a portfolio of overseas assets, his primary concern would have to be the “slings and arrows” of currency markets — which are notoriously difficult to call but can meaningfully impact portfolio returns.

For Canadian investors, looking abroad provides several benefits. The most important is diversification, whether it’s through access to other regions that are less correlated with Canadian markets or to other products that aren’t available domestically. However, investing abroad also means taking on foreign exchange risk given that international assets are priced in currencies other than the Canadian dollar (CAD).

For illustrative purposes, consider Chart 1 which shows the total return for the S&P 500 in U.S. dollars (USD) and CAD terms for Q1 of this year. In USD terms, the index was up 10.6% over that time frame, but since that period also experienced weakness in the CAD relative to the USD (or USD/CAD moved higher) the index outperformed in Canadian dollar terms (up 13.3%). That means that Canadian investors would have fared much better leaving their USD exposure unhedged ex ante.

Chart 1 – S&P 500 Total Return for Q1 2024

Now let’s look at an alternative period in which the CAD strengthened against the USD. Chart 2 shows a comparison of the total return for the S&P 500 from April 2020 to April 2021 (in which USD/CAD was lower by over 11%). During this period, the total return index outperformed in USD terms by close to 20%. In this scenario, an investor who had hedged their FX risk would have been in the optimal position.

Chart 2 – S&P 500 Total Return Between April 2020-April 2021

As these examples show, currency risk is a key consideration for any investor who is looking beyond Canada for diversification. That risk can cut both ways, which amplifies the importance of hedging decisions. In our minds, the decision to hedge FX risk (including the degree to which foreign exposure is hedged) comes down to the following:

- An investor’s view of the underlying currency pair

- Whether the currency pair is positively or negatively correlated with the underlying asset

In this note, we’ll make a brief comment on the first point but focus largely on the second one as we feel that should be given more weight for hedging decisions.

FX Markets Are Tough to Call

Taking a view on the underlying currency pair is easy to do — but difficult to capitalize on.

Indeed, foreign exchange markets are notoriously fickle. One reason why is the relationship between predictive factors and currency pairs is rarely stationary. For instance, a lot of market participants tend to use front-end (2-year) yield spreads as a proxy for central bank divergence in the spot FX market. Chart 3 shows the correlation between those spreads and the different CAD crosses, and as expected, the relationship isn’t consistent from a cross-sectional perspective.

Chart 3 – Correlation Between Two-Year Spreads and the CAD Crosses

We can also see this by examining the relationship between one factor and a currency pair over time. Chart 4 shows the rolling 100-day correlation between USD/CAD and the price of oil (proxied by the prompt WTI contract) going back 10 years. Note how frequently the strength of the correlation (as well as the sign) changes over time.

Additionally, there is no bulletproof way to come up with a cogent ‘fair value’ model for a currency pair. Not only because the nature of the relationship with factors is inconsistent, but also because (unlike stocks or bonds) there is no future cash flow to discount. The changing nature of the macro alongside the sheer size and depth of the FX market makes it near impossible to have an edge, or generate alpha over the long-term — particularly for developed market currency pairs.

Of course, this is not to say that a view on the currency pair isn’t important. Even if relationships are unsteady, there is still some information to be gleaned for FX when oil prices trend a certain way, or if we do see a degree of central bank divergence. This will always be an important input for projecting returns for a hedged or unhedged investment.

Rather, the point is that an investor needs to augment the input from a currency view with something else to make an informed decision on whether or not to hedge FX risk.

Chart 4 – Rolling 100-Day Correlation Between USD/CAD and Oil Prices Over Time

How to Approach the Hedging Decision

For Canadian investors, there are a lot of domestic ETFs that allow for participation in the U.S. markets. For those that are denominated in CAD, issuers offer both hedged and unhedged versions depending upon the investor’s preference. However, there are options for those investors to instead buy USD-denominated ETFs that track U.S. markets, but trade on Canadian exchanges.

Since mid-2021, an option for Canadian investors who wanted access to the S&P 500 would have been to buy the unhedged ETF (including ZSP which is the BMO S&P 500 Index ETF). That’s primarily because the CAD has weakened relative to the USD over that time frame, which has provided an additional return on top of the underlying.

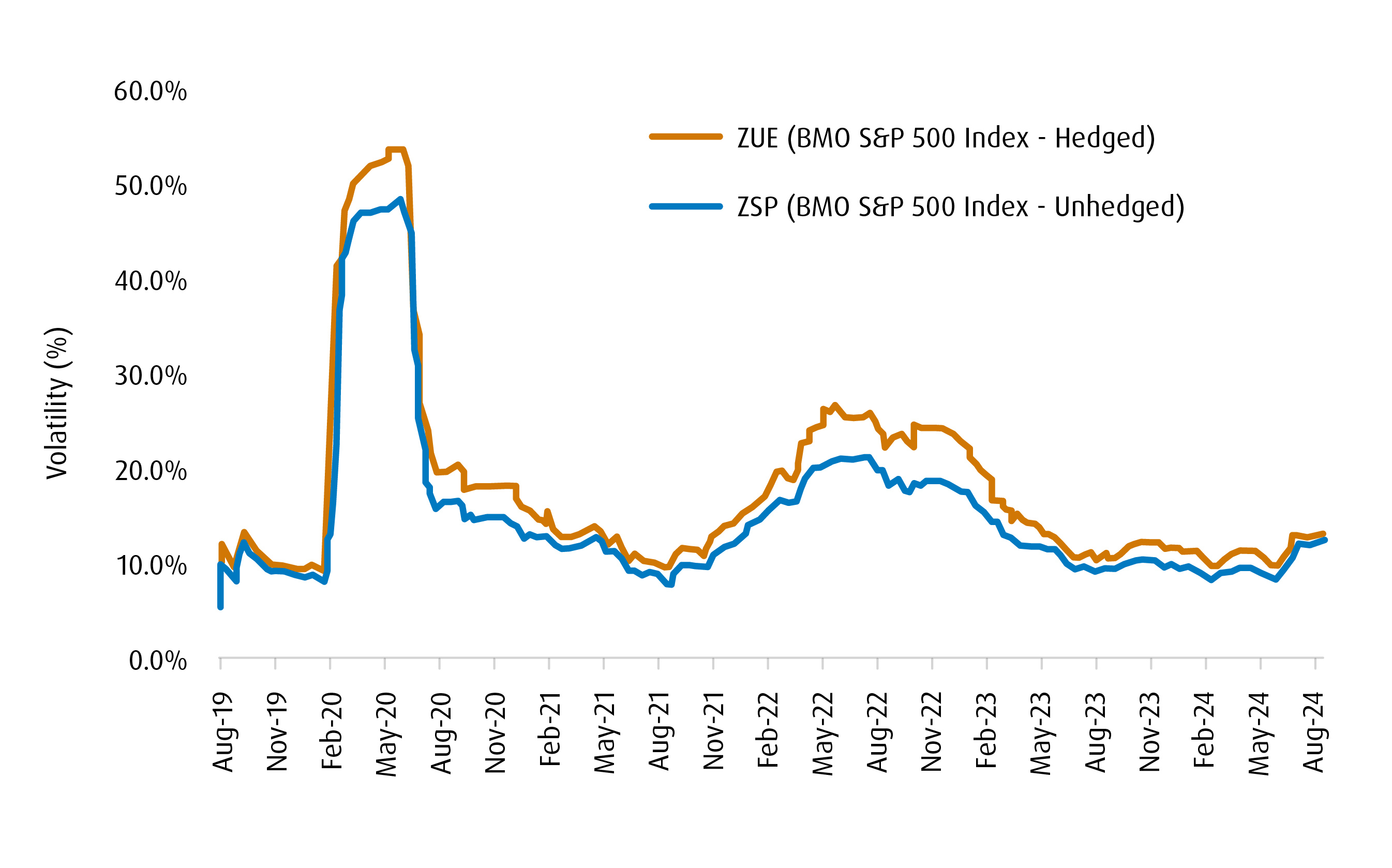

However, focusing on returns masks something else that’s important to consider. Indeed, the ZSP offers yet another advantage relative to its cousin ETF which hedges for FX risk (ZUE or BMO S&P 500 Hedged to CAD Index ETF) – it’s far less volatile. For instance, Chart 5 shows a comparison between the 90-day realized volatility for the ZUE and ZSP over the past few years. Most of the time, it’s the unhedged ETF (or the ZSP) which has the lower volatility. What this means is that investors who hedged their exposure would not only have had lower returns, but their volatility profile would have increased as well.

Chart 5 – A Comparison of 90-Day Volatility for the ZUE and ZSP1

Admittedly, that feels counterintuitive. After all, shouldn’t hedging FX risk mitigate volatility given that currency risk is negated?

Unfortunately, it’s not that simple. Recall, that when a Canadian investor buys an unhedged U.S.-tracking ETF, that investor is effectively long the underlying asset and the USD. Over the past several years, the performance of the USD has been (directionally) inversely correlated with the S&P 500. This is due to the USD’s appeal as a liquid safe-haven during periods of risk-off. That means that by not hedging their USD risk, Canadian investors are adding an uncorrelated asset – which reduces volatility at the margin.

Table 1 – A Comparison of Returns and Vols for ZUE and ZSP for the Past Two Years

| ZUE (Hedged) | ZSP (Unhedged) | |

| Return | 49.38% | 51.70% |

| Average 90-Day Volatility | 14.64% | 12.17% |

September 30, 2022 to September 30, 2024.

Chart 6 – The S&P 500 is Negatively Correlated to USD/CAD

A Simple Rule You May Follow…

As a general rule, for any ETF that tracks a foreign market, if the basket of underlying securities is…

- Negatively correlated to the foreign currency -> there is a diversification benefit from currency exposure

- Positively correlated to the foreign currency -> there is less of a diversification benefit from currency exposure

In the case of I), the unhedged version of the ETF would provide less volatility than the hedged version. For II), the reverse is more likely to be true.

For a Canadian investor looking to increase allocation to broad risk in the U.S. (say the S&P 500), it makes more sense to stick with an unhedged ETF (ZSP). That also dovetails nicely with the view that the Bank of Canada will likely have to ease by more than is currently priced into the OIS market – which would hit the CAD.

However, correlation regimes can change. For instance, let’s say the regime flips, and the USD becomes positively correlated with broad risk. In that scenario, the Canadian investor would likely have to consider a hedged ETF – provided that the CAD isn’t underperforming the USD in that environment. The only environment in which this scenario makes sense is if there is a USD-specific shock that doesn’t impact US equities. One scenario in which this could happen is if the market starts attaching a greater premium in the USD for sustained budget deficits.

All told, the above provides a framework for hedging decisions for our readers when it comes to investing outside of the Canadian market. Much like our friend Hamlet in his famous speech, having a plan allows investors to “take arms against a sea of troubles — and by opposing (potentially) end them.”

1 Annualized Performance Data, ZSP and ZUE:

Performance (%) |

YTD |

1-Month |

3-Month |

6-Month |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception |

24.32 |

2.48 |

4.59 |

10.08 |

35.28 |

13.99 |

16.07 |

15.10 |

17.53 |

|

21.03 |

2.04 |

5.45 |

9.64 |

34.31 |

10.27 |

14.21 |

11.83 |

13.36 |

As of September 30, 2024. ZSP inception date was November 12, 2012. ZUE inception date was May 29, 2009.

Disclaimers

For Advisor Use Only. No portion of this communication may be reproduced or distributed to clients.

This communication is intended for information purposes only.

The information contained herein is not, and should not be construed as, investment advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc., BMO Investments Inc., BMO Asset Management Inc. and BMO’s specialized investment management firms. BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate legal entity from the Bank of Montreal.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.