What to Expect This Week

March 31, 2025Topics covered…

- Tariff update

- Portfolio strategy note

- Canadian election expectations

- US economic indicators round up

Into the start of the week – Asian and European markets under considerable pressure. In Japan, the Nikkei closed lower by 4% from Friday, while the Euro Stoxx 50 is down by 1.75% at time of writing.

In North America, US equity futures imply that markets will open on the defensive later this morning. At the same time, the ‘risk-off’ trade is extending into the fixed income space with core sovereign yields mostly lower and the US market outperforming.

Elsewhere, Gold continues to shine with spot prices now above $3100/oz.

1.) Tariff Updates:

a.) Here are the order of operations for this week…

- Tuesday (April 1): The America First Trade Policy Memo will be released. This is the report that culminates from the executive order issued on January 20th that directs the Departments of Commerce, Treasury as well as the US Trade Representative to conduct studies ranging from the cause of persistent trade deficits to exchange rate manipulation and trade ‘reciprocity’. For Trump, this will serve as the foundational document for trade over the rest of his term.

- Wednesday (April 2): “Liberation Day”.

For Wednesday, there are four things to watch for. First, whether the exemption on USMCA-compliant goods is allowed to expire. This would effectively mean 25% tariffs across the board for all imports coming into the US from Canada/Mexico – with energy tariffed at 10%. Keep in mind, that Canada’s second round of retaliatory tariffs covering C$125bln worth of US goods kicks into effect on the same day.

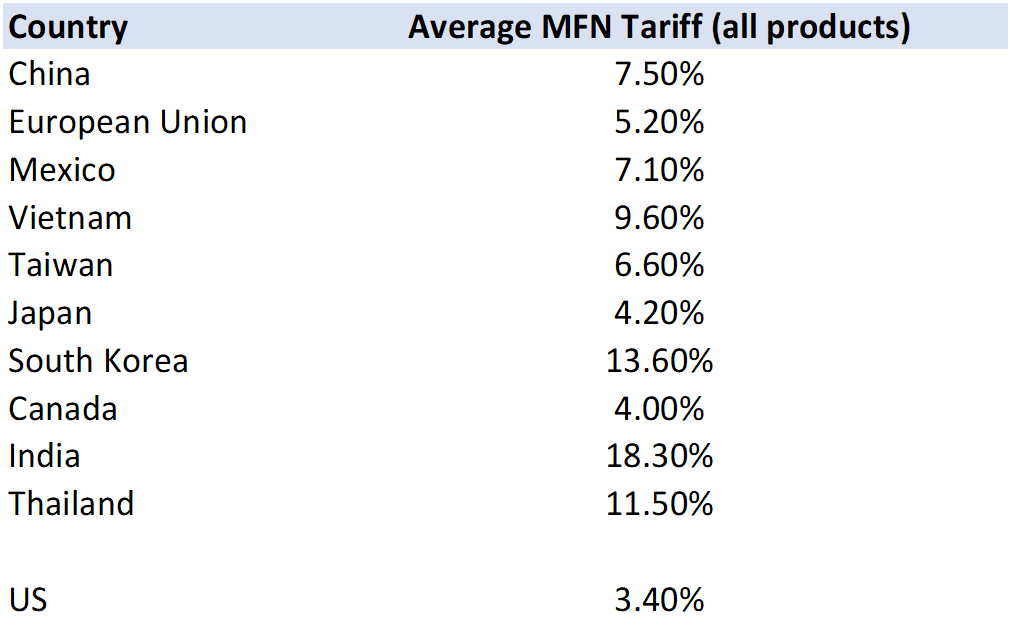

Second, the reciprocal tariff announcement (likely on a country-specific basis). This is intended to cover the discrepancies in average tariffs between what the US imposes versus other countries. Table 1 displays the average applied ‘most favoured nation’ (MFN) tariffs by countries on imports. A WSJ article over the weekend suggested that the President might just eschew this approach in favour of an “across the board” 20% tariff.

Table 1 – Average MFN Tariffs (all products) by Country

Source: WTO, BMO GAM

Also, the reciprocal tariffs will cover “unfair or discriminatory taxes” levied by other countries against US companies. Value-added taxes (VAT), digital services tax (DST), and the OECD’s Pillar II minimum 15% tax would be covered here. In addition, non-tariff barriers (subsidies) as well as currency manipulation and market access limitations will be considered for the ‘country-specific’ rate.

Third, the 25% tariffs on auto manufacturing go into effect. And finally, the 25% ‘secondary tariff’ on any country that buys oil and gas from Venezuela.

b.) How will markets react?

For reciprocal tariffs, that there is a lot of room for subjectivity at Trump’s discretion. Ultimately, these depend on what his end goal really is – which might be communicated indirectly by how these are implemented.

For instance, if his end goal is to use tariffs to source revenues and to re-shore businesses to the US – then the tariffs announced on Wednesday should go into effect right away. That would be the ‘worst case’ outcome for markets because of what they signal. I would reckon that this is the base case right now and a key reason for why markets are on the defensive.

However, if tariffs are his way of extracting leveraging to create a deal with trading partners to address persistent trade deficits and/or non-trade barriers – then I’d suspect that implementation is pushed further out by a few weeks at least. This would create space and time for negotiation – which markets would be receptive to.

c.) Ultimately, over the long-term, US markets are far more vulnerable for the following reasons:

- The US runs a massive financial account surplus with the rest of the world (meaning more foreign money is invested in the US than vice versa).

- The current phase of US economic expansion is feeling mature.

- Trump’s policies are inherently inconsistent and risk turning off foreign investors.

On the last point – consider the US’ ‘secondary tariff’ on countries that buy oil from Venezuela and Russia. You cannot be an interventionalist in how business is done in other countries while operating in a more isolationist manner (via tariffs). What that inevitably means is that countries will turn away from conducting business with you and turn to other assets.

By extension, that is why an asset like Gold continues to outperform.

2.) Portfolio Strategy:

When it comes to tariffs and the passthrough to markets, our philosophy is summed up by two phrases: “Hope for the best, prepare for the worst” and “Caution over exuberance”.

As far as we’re concerned, this isn’t the time to be bold. For Q2, this will mean that…

- We’re remaining defensive in terms of asset allocation splits.

- We continue to like regional diversification when it comes to the equity sleeve of our portfolio. In particular, we have a preference for funds that track high dividend EUR underlyings on an unhedged basis (ZDI).

- For the fixed income sleeve, we’re targeting higher quality credit and optimizing for yield/duration (ZBI).

- In alternatives – we’re relying heavily on a constructive view for infrastructure (ZGI) and Gold (ZGLD).

Additionally, we see increased risks of slower growth and higher inflation in the developed world. To us, that suggests that inflation-linked products (TIPS in the US) should perform in the near-term as a tactical play.

At the same time, we expect to see duration come under a bit of pressure in both Canada and the US. In Canada, we suspect that this will be driven by the term premium as anticipated fiscal easing begets more coupon issuance. In the US, a mix of long-term Fed policy expectations and upward pressure on breakevens will likely drive long-end premiums higher.

We will be publishing our updated Portfolio Strategy later this week.

3.) In Canada:

a.) The latest poll updates from 338Canada.

- The Liberals are projected to win 192 seats (up from 178 last week)

- The Conservatives are projected to win 125 seats (from 131 last week)

- The BQ are at 19 seats (27 seats last week)

- NDP at 6 seats (7 seats last week)

The odds of a Liberal majority are now at 89%. A stunning turn of events from a few months back.

The “Carney effect” is in full force.

b.) Meanwhile, the latest Polymarket odds on the Canadian election have Carney at 65% and Poilievre at 36%.

c.) In case you missed it, here is a link to the readout that Carney released immediately after his call with Trump on Friday.

Note that both Carney and Trump agreed to begin talks on a “new economic and security relationship” immediately following the election (provided that Carney is still the PM).

And, as many have noted, Trump’s post of the call referenced Carney as the “Prime Minister of Canada”.

Our take: I’ll likely dive into this in a future note, but the ‘hot take’ here is that this is another potential step to a “Fortress North America” instead of a “Fortress America”.

d.) On Friday, industry-level GDP data contained a few positive surprises.

- The headline for January was firmer than expected at +0.4% m/m. The December print was also revised higher to +0.3% m/m.

- Thirteen out of 20 sectors increased on the month – with the aggregate readings for both goods and services higher too. In fact, GDP for goods sectors rose by 1.1% m/m (the highest monthly reading in over 3 years).

- The advance reading for February GDP was flat.

What does this figure tell us? For one, Q1 GDP is now tracking 2.0% - which is a bit below the BoC’s own forecast. We don’t have the March data just yet, but we’d expect Q1 ends up a bit below 2.0% when the number is released in a few months time.

Second, it really doesn’t matter. Assuming the auto, steel and aluminum tariffs stay on, the economy is likely to slow considerably in Q2 (likely negative). And that’s before we considering the corresponding impacts from the comprehensive + reciprocal tariffs.

4.) In the US

a.) A few notes need to be made about US data from Friday…

- The savings rate is increasing among households. Some have noted that this means there’s more spending power potentially down the road, but I’d read it as another sign that the economy is slowing.

- The reason for that is the dual impact from US policy uncertainty and higher prices. The three-month annualized rate for PCE is now the highest that it’s been for some time now.

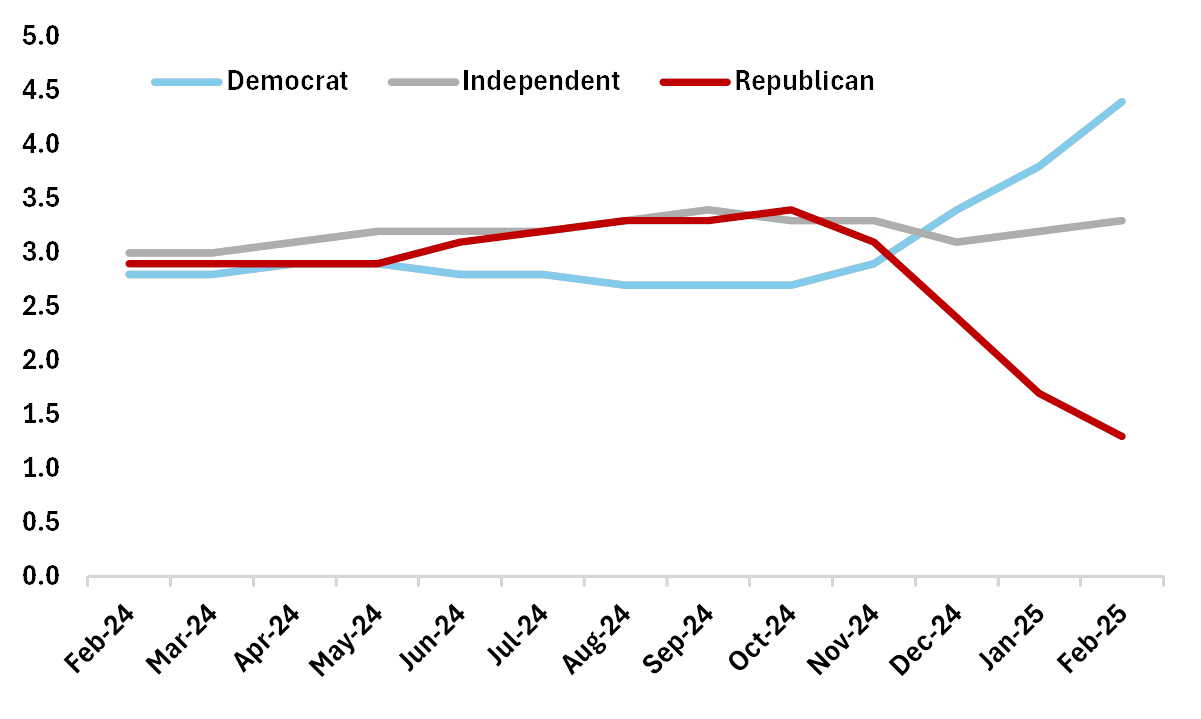

- The final Michigan survey numbers were bad. Expectations are now the lowest they’ve been in years while long-term inflation expectations are the highest they’ve been since 1993.

Yes, there’s a whiff of partisanship in the Michigan reading which means the final result is likely overstated. Nevertheless, shifts to higher price expectations (even among a segment of the population) can eventually filter through to prices. In many cases – much more easily than shifts to lower price expectations.

Markets are leaning a bit more in the ‘stagflation’ direction.

Chart 1 – Expected Changes in Prices over the Next 5 Years (median of 3-month moving average)

Source: University of Michigan Sentiment Survey for March (final), BMO GAM

b.) Trump threatens secondary tariffs on countries that buy Russian oil. This comes after he said he was “pissed off” at Russian President Putin for dragging his heels over a ceasefire with Ukraine.

Additionally, the Trump administration is revoking permits and licenses that enable western oil companies to do business with Venezuela’s state oil company, PDVSA. In other words, any western company that produces energy (gas) refined from Venezuelan crude will not be able to sell it into the US market.

c.) In case you missed it – Trump says that he is “not joking” about seeking a third term in 2028 and that “there are methods which you could do it.”

Our take: Points b) and c) are important reasons for why foreign investors are pulling out of the US market. Trust in US institutions is eroding at the margin – and fast.

d.) Meanwhile, Navarro says that tax cuts should offset whatever pain households see from rising prices due to tariffs.

5.) In China

a.) Four of the largest Chinese banks will raise a combined CNY520bln via share sales to investors this week.

One of the investors will include the Ministry of Finance – as the government is keen to increase core tier one capital in Chinese banks to boost lending to the real economy.

Our take: Naturally, this is another way for authorities to ensure that capital is readily available when loan demand starts to pick up.

b.) On the data front, PMIs for manufacturing and services came in a bit above expectations for March. That left the CFLP Composite PMI tracking at 51.4.

6.) Important Data/Events for This Week:

Mon March 31

- Germany: CPI (March – prelim)

- China: Caixin PMIs (March)

Tues April 1

- US: JOLTS job openings (Feb), ISM manufacturing (March), ‘America First’ Trade Policy Memo

- UK: Manufacturing PMIs (March)

- Japan: Unemployment (Feb), Tankan surveys (Q1)

- Eurozone: HCOB PMI manufacturing (March), CPI (March – prelim), Unemployment (Feb)

- Australia: RBA decision

Wed April 2

- US: ADP employment (March), “Liberation Day” tariffs

- Canada: Retaliatory tariffs to go into effect

- India: PMI Manufacturing (March)

- Japan: Services PMI (March)

Thurs April 3

- US: Initial jobless claims, ISM services (March), Merchandise trade (Feb)

- Canada: Int’l merchandise trade (Feb)

- Eurozone: HCOB services PMI (March)

- China: Caixin Services PMI (March)

Fri April 4

- US: Nonfarm payrolls (March), Fed Chair Powell speaks

- Canada: Labour force survey (March)